Apple shall be saying the first-quarter outcomes for 2025 on January 30. This is what to anticipate from what needs to be a blockbuster monetary launch.

Apple’s Q1 2025 monetary outcomes shall be launched on Thursday, January 30, a short while forward of the analyst and investor convention name at 5p.m. Japanese.

The decision will function CEO Tim Cook dinner explaining the monetary particulars from the outcomes, however he could have a brand new individual on the decision with him. Former CEO Luca Maestri bid farewell in October’s earnings name, with Kevan Parekh set to take his seat within the quarterly name.

Whereas Cook dinner did take time to reward Maestri throughout his final convention name as CFO, it is extra doubtless that Parekh’s welcome shall be a a lot faster affair.

Final quarter: This autumn 2024 particulars

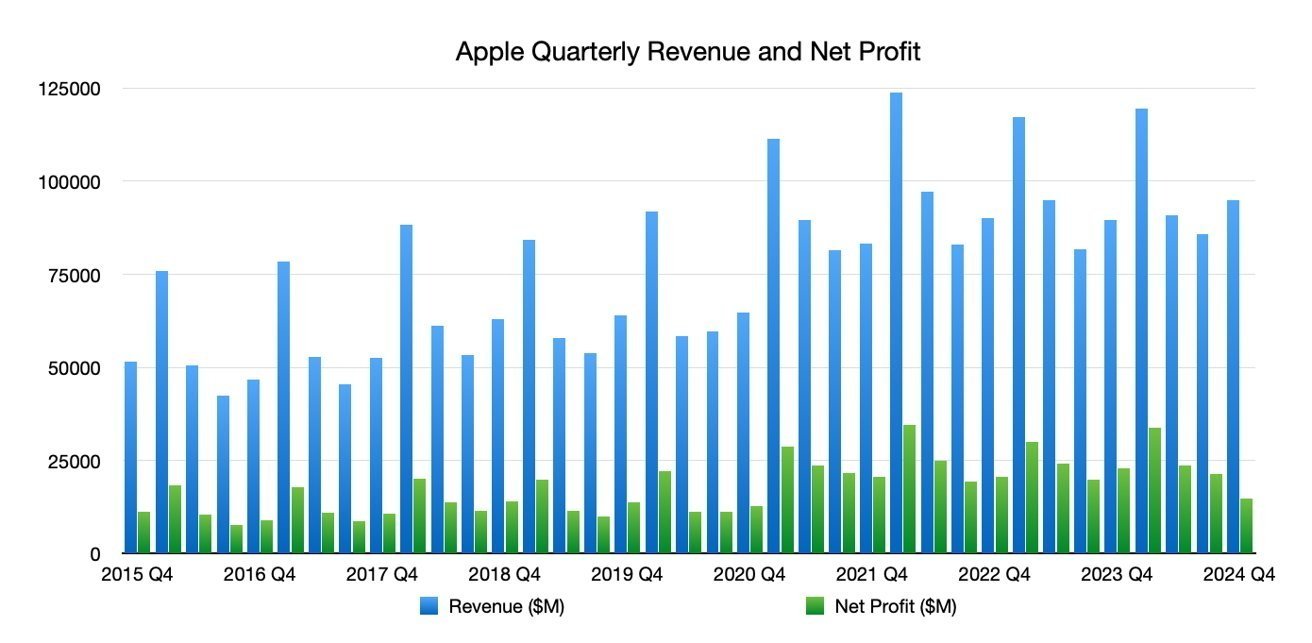

The This autumn outcomes noticed Apple haul in $94.93 billion in income, up from $89.5 billion one 12 months prior. Apple additionally declared an earnings per share of $1.64.

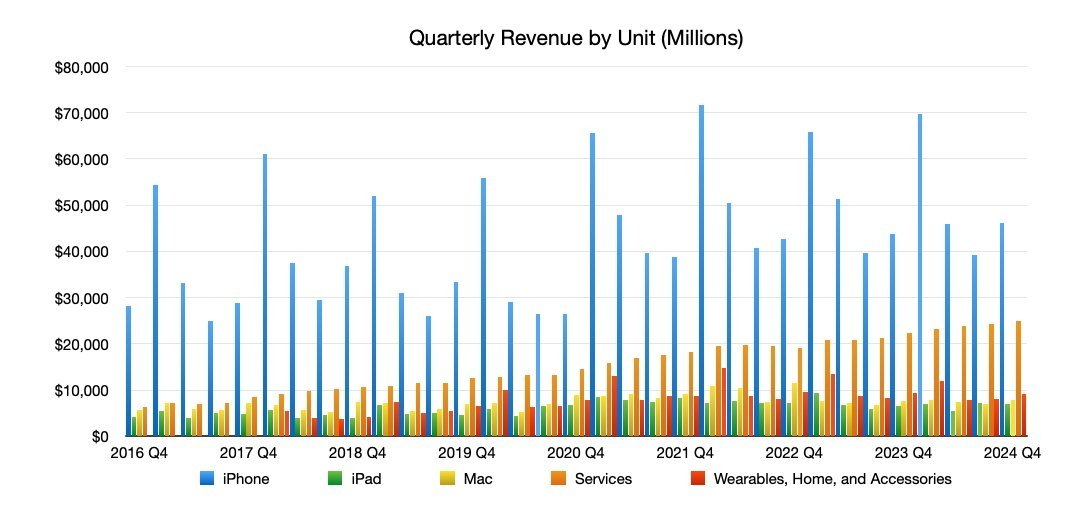

iPhone income was up 5.5% year-on-year to $46.22 billion, with iPad up 7.9% to $6.95 billion. Mac additionally noticed a rise, however of 1.7% at $7.74 billion, whereas Providers continued rising with a 11.9% YoY enhance to $24.7 billion.

Wearables, Dwelling, and Equipment was the one blemish, dropping 3% year-on-year to $9.32 billion.

The interval noticed the launches of the iPhone 16 vary, AirPods Max with USB-C, the Apple Watch Sequence 10, and an Apple Watch Extremely 2 in black. Nevertheless, as common, these releases could have solely partly helped in This autumn 2024, with them extra prone to have an effect on the Q1 2025 outcomes as a substitute.

Apple is a extremely seasonal firm, making sequential quarterly evaluation not a lot of a information for quarterly forecasts. What it does do is supply a glimpse of the lead into the quarter, by seeing the place the earlier one left off.

With This autumn 2024 being about 6% higher year-on-year than This autumn 2023’s complete, this offers Q1 2025 start line to construct from. Nevertheless a extremely poor vacation season might simply undo that progress.

12 months-ago quarter: Q1 2024

Launched in February 2024, the Q1 2024 outcomes are the figures Q1 2025 goal to beat. The seasonality of Apple’s enterprise signifies that Q1 is the largest for the corporate within the 12 months.

It is the quarter that occurs simply after the launches of the newest iPhones, and infrequently includes different early-in-period launches too. Then there’s the vacation gross sales interval, which may make a huge impact on the quarter as nicely.

These components, in addition to the general significance of Q1 in Apple’s fiscal 12 months, means the earlier 12 months’s Q1 efficiency is a measurable yardstick to check the most recent Q1 outcomes in opposition to.

On the time, Apple reported income of $119.58 billion, marginally rebounding earnings from one 12 months prior of $117.15 billion by a mere 2%. Whereas a optimistic income degree is nice for Apple, it is probably not that a lot of a rise and may very well be thought of near flat progress by traders.

The EPS was set at $2.18, up from $1.88.

Damaged down, the iPhone income of $69.7 billion was up from the $65.78 billion of the year-ago quarter, with Mac income additionally as much as $7.78 billion versus $7.74 billion in Q1 2023. iPad income was down, from $9.4 billion in Q1 2023 to $7.02 billion in Q1 2024.

Wearables, Dwelling, and Equipment noticed a one-year drop from $13.48 billion to $11.95 billion. Providers was dependable as ever, rising from $20.77 billion to $23.12 billion.

The few billions of enchancment from iPhone and Providers, and to a lesser extent Mac gross sales, largely offset the billions in drops seen by iPad and Wearables. If the down quarters have been as a substitute flat, Apple might’ve successfully doubled its income progress within the interval.

As for iPhone particularly, stories level to the iPhone 16 Professional fashions dominating, whereas non-Professional fashions are seemingly lackluster. It is a development that’s typically seen post-launch, with the premium fashions getting an early benefit, however it’s anybody’s guess whetherthat interprets into diminished or elevated gross sales total.

On the time, Cook dinner reported an set up base of lively units exceeding 2.2 billion. He was additionally upbeat concerning the prospect of the just-launching Apple Imaginative and prescient Professional. The much less stated concerning the Apple Imaginative and prescient Professional, the higher.

What occurred in Q1 2025

By way of product launches, Apple noticed much more within the interval past the This autumn launches, which could have a serious impact on the funds of the vacation quarter.

In October, Apple up to date the iPad mini to make use of the A17 Professional, adopted by updating the Magic Mouse 2, Magic Trackpad 2, Magic Keyboard, and Magic Keyboard with Contact ID.

Apple used November to lastly improve the Mac vary to the M4 degree of Apple Silicon. The most important change was the revamp of the Mac mini, which makes use of a a lot smaller design and new port placements, and noticed a heat reception from critics.

Different Mac launches that month embrace the 24-inch iMac and updates to M4 for the MacBook Professional.

Whereas the Q1 releases will not essentially have as a lot of an affect on the quarter attributable to being launched through the interval, it is doubtless that they’ll nonetheless have some impact because of the vacation gross sales interval.

The important thing ingredient to look out for is iPhone gross sales, as that continues to be the largest consider how the quarter goes for the corporate. With the continued gradual rollout of Apple Intelligence, it may very well be that Apple’s software program push may very well be an enormous consider producing gross sales, if it will probably proceed its growth and growth at tempo.

The shift to M4 chips within the core Mac and MacBook traces will in all probability convey in additional gross sales too, particularly for the Mac mini’s radical redesign. Nevertheless it’s uncertain that Mac will make as a lot of a dent as a small iPhone income change.

Analyst forecasts

Following the This autumn 2024 outcomes, analysts provided their sizzling takes on the interval. Nevertheless, they have been extra within the Q1 2025 outcomes.

The sentiment was of cautious optimism.

Morgan Stanley stated its Q1 outlook is “combined” with lighter income than shopping for expectations, however with a greater gross margin than the consensus view. Evercore ISI pointed to single-digit progress in Q1 and a extra staggered iPhone cycle.

In evaluation from January 3, The Motley Idiot writes that Apple remains to be a formidable inventory decide, due to its excessive income versus its friends. Nevertheless, progress has been seen to be slower, at 2% versus 10% or extra for Alphabet or Microsoft.

With combined outcomes throughout its product classes, Providers is seen as a continuous vivid spot. Its free money circulation remains to be staggering, and nonetheless rising, with Apple additionally prioritizing a return in capital to shareholders.

Forbes provided on November 21 its prediction for Apple in 2025, the iPhone continues to be a centerpiece of the enterprise, however China is a problem for each manufacturing and gross sales. Providers phase income shall be a driver for the corporate, and it is key for the longer term because it’s poised to turn out to be “a second juggernaut enterprise line” that may make up for {hardware} phase cycles.

The report finds that Apple’s problem in 2025 will not be in producing huge income, however extra needing to justify its valuation to traders.