Apple’s iPhone 16 launch is off to a gradual begin, with early gross sales suggesting that consumers is perhaps extra desirous about 2023’s fashions than the most recent upgrades.

In line with early knowledge, the iPhone 16 fashions, launched in September 2024, seem like off to a slower begin in comparison with final yr’s iPhone 15 lineup. Not like latest years, the 2024 launch aligns intently with Apple’s typical pre-pandemic launch schedule, offering a comparable have a look at year-over-year efficiency.

Reviews, together with one from Client Intelligence Analysis Companions (CIRP), reveal that the iPhone 16’s preliminary gross sales have not matched the swift uptake of the iPhone 15 lineup from the identical interval in 2023.

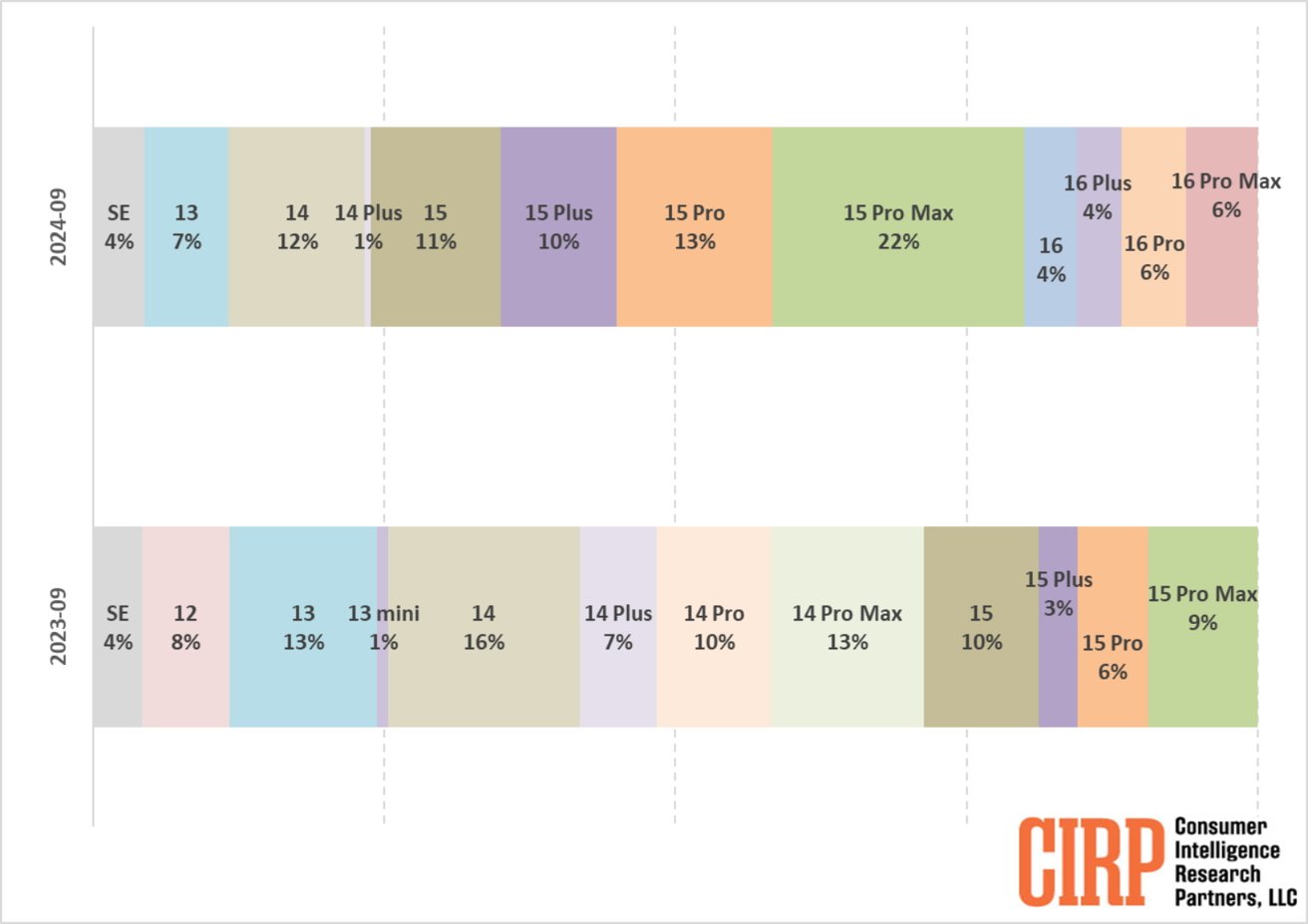

Throughout their first two weeks of gross sales, these fashions collectively represented a 20% share of U.S. iPhone gross sales. In distinction, the iPhone 15 collection captured a considerably greater 29% share throughout the identical timeframe in 2023, indicating a noticeable drop in early adoption for the most recent fashions.

This distinction turns into much more obvious when analyzing the high-end fashions. In September 2024, the iPhone 16 Professional and Professional Max constituted 12% of complete iPhone gross sales, down from the iPhone 15 Professional and Professional Max’s 15% share in the identical interval a yr prior.

Given Apple’s continued gross sales of its legacy fashions alongside new ones, the shift in client curiosity from the most recent releases to final yr’s fashions is especially noteworthy.

iPhone mannequin distribution (quarters ending in September 2024 and September 2023). Picture credit score: CIRP

The persistence of older fashions available in the market supplies additional context to this development. In September 2023, iPhone 13 and older fashions accounted for round 26% of U.S. gross sales, whereas in 2024, iPhone 14 and older fashions contributed to 24% of gross sales, indicating a comparatively regular desire for older gadgets over time.

The consistency contrasts with the noticeable shift towards year-old fashions in 2024. In 2023, iPhone 15 fashions accounted for 56% of gross sales within the September 2024 quarter, a notable enhance from the 46% share the iPhone 14 fashions held in 2023.

The ten% enhance in demand for the outdated fashions suggests a reluctance amongst customers to improve to the most recent releases instantly.

Analyst views on future efficiency

Analysts have famous changes in Apple’s manufacturing technique to accommodate these dynamics. JP Morgan reported that whereas demand for the iPhone 16 collection is secure, it barely trails the iPhone 15 collection in availability and transport instances.

Notably, U.S. transport instances for the iPhone 16 Professional Max have shortened from 21 days in 2023 to fifteen days in 2024, indicating Apple’s efforts to effectively handle provide for its premium fashions.

In the meantime, analyst Ming-Chi Kuo noticed that demand for the iPhone 16 Professional fashions has met Apple’s expectations, prompting the corporate to keep up manufacturing even throughout China’s Nationwide Day vacation to satisfy orders. Nonetheless, demand for the iPhone 16 and 16 Plus has been extra subdued, main Apple to cautiously reduce on some part orders for these baseline fashions by an estimated 3% to five%.

Whereas the discount displays the tepid demand for non-Professional fashions, it is unlikely to considerably influence total manufacturing ranges, as Apple maintains regular output for the high-demand Professional fashions.

As the vacation season approaches, Apple may even see renewed curiosity, particularly within the iPhone 16 Professional fashions. The interval might immediate a reevaluation of the positioning and attraction of the usual iPhone 16 and 16 Plus, probably setting a brand new route for future product cycles.