A monetary agency registered in Canada has emerged because the cost processor for dozens of Russian cryptocurrency exchanges and web sites hawking cybercrime providers geared toward Russian-speaking clients, new analysis finds. In the meantime, an investigation into the Vancouver avenue tackle utilized by this firm exhibits it’s house to dozens of overseas forex sellers, cash switch companies, and cryptocurrency exchanges — none of that are bodily situated there.

Richard Sanders is a blockchain analyst and investigator who advises the legislation enforcement and intelligence neighborhood. Sanders spent most of 2023 in Ukraine, touring with Ukrainian troopers whereas mapping the shifting panorama of Russian crypto exchanges which can be laundering cash for narcotics networks working within the area.

Extra just lately, Sanders has targeted on figuring out how dozens of standard cybercrime providers are getting paid by their clients, and the way they’re changing cryptocurrency revenues into money. For the previous a number of months, he’s been signing up for varied cybercrime providers, after which monitoring the place their buyer funds go from there.

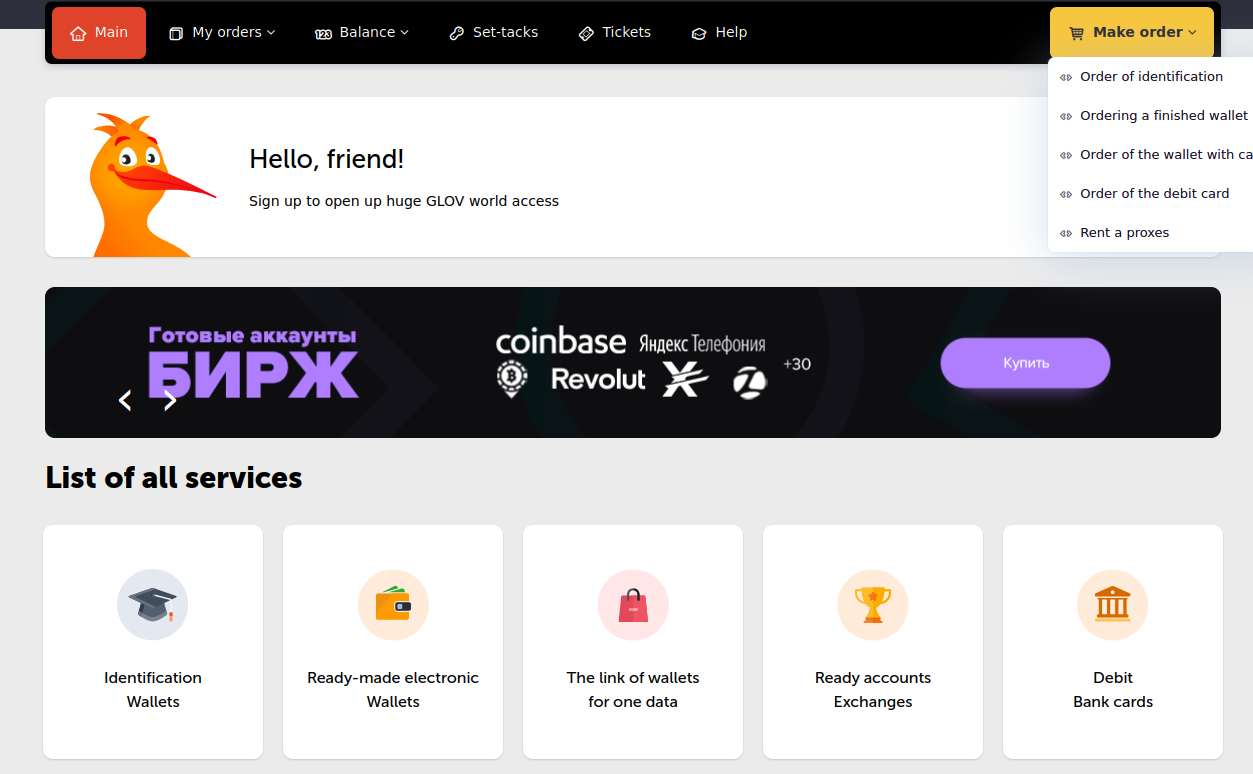

The 122 providers focused in Sanders’ analysis embody a number of the extra distinguished companies promoting on the cybercrime boards in the present day, akin to:

-abuse-friendly or “bulletproof” internet hosting suppliers like anonvm[.]wtf, and PQHosting;

-sites promoting aged e mail, monetary, or social media accounts, akin to verif[.]work and kopeechka[.]retailer;

-anonymity or “proxy” suppliers like crazyrdp[.]com and rdp[.]monster;

-anonymous SMS providers, together with anonsim[.]internet and smsboss[.]professional.

The positioning Verif dot work, which processes funds by Cryptomus, sells monetary accounts, together with debit and bank cards.

Sanders mentioned he first encountered a few of these providers whereas investigating Kremlin-funded disinformation efforts in Ukraine, as they’re all helpful in assembling large-scale, nameless social media campaigns.

In response to Sanders, all 122 of the providers he examined are processing transactions by an organization known as Cryptomus, which says it’s a cryptocurrency funds platform primarily based in Vancouver, British Columbia. Cryptomus’ web site says its dad or mum agency — Xeltox Enterprises Ltd. (previously certa-pay[.]com) — is registered as a cash service enterprise (MSB) with the Monetary Transactions and Reviews Evaluation Centre of Canada (FINTRAC).

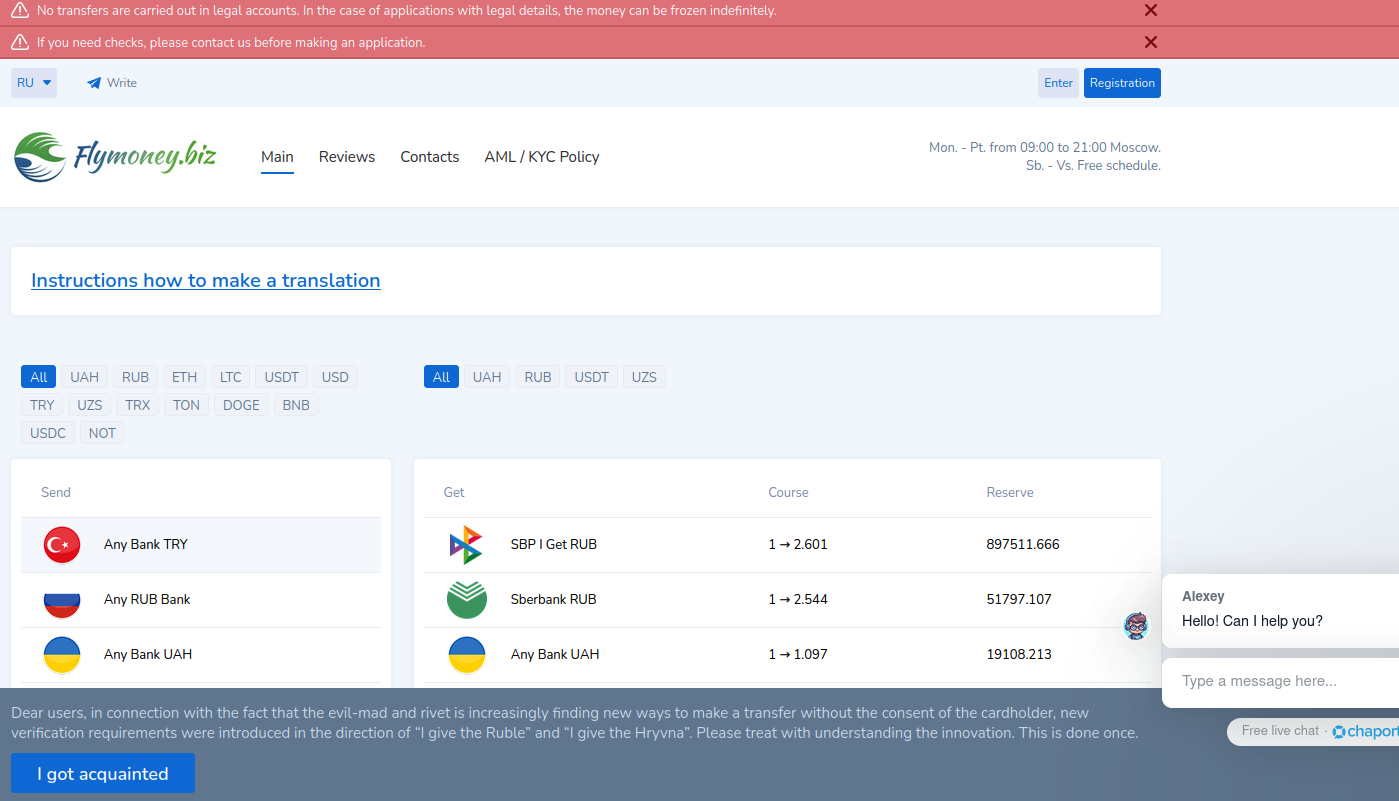

Sanders mentioned the cost information he gathered additionally exhibits that a minimum of 56 cryptocurrency exchanges are at present utilizing Cryptomus to course of transactions, together with monetary entities with names like casher[.]su, grumbot[.]com, flymoney[.]biz, obama[.]ru and swop[.]is.

These platforms are constructed for Russian audio system, they usually every promote the flexibility to anonymously swap one type of cryptocurrency for one more. In addition they permit the alternate of cryptocurrency for money in accounts at a few of Russia’s largest banks — practically all of that are at present sanctioned by america and different western nations.

A machine-translated model of Flymoney, considered one of dozens of cryptocurrency exchanges apparently nested at Cryptomus.

An evaluation of their expertise infrastructure exhibits that every one of those exchanges use Russian e mail suppliers, and most are immediately hosted in Russia or by Russia-backed ISPs with infrastructure in Europe (e.g. Selectel, Netwarm UK, Beget, Timeweb and DDoS-Guard). The evaluation additionally confirmed practically all 56 exchanges used providers from Cloudflare, a worldwide content material supply community primarily based in San Francisco.

“Purportedly, the aim of those platforms is for corporations to simply accept cryptocurrency funds in alternate for items or providers,” Sanders informed KrebsOnSecurity. “Sadly, it’s subsequent to inconceivable to search out any items on the market with web sites utilizing Cryptomus, and the providers seem to fall into one or two totally different classes: Facilitating transactions with sanctioned Russian banks, and platforms offering the infrastructure and means for cyber assaults.”

Cryptomus didn’t reply to a number of requests for remark.

PHANTOM ADDRESSES?

The Cryptomus web site and its FINTRAC itemizing say the corporate’s registered tackle is Suite 170, 422 Richards St. in Vancouver, BC. This tackle was the topic of an investigation revealed in July by CTV Nationwide Information and the Investigative Journalism Basis (IJF), which documented dozens of instances throughout Canada the place a number of MSBs are included on the similar tackle, usually with out the information or consent of the situation’s precise occupant.

This constructing at 422 Richards St. in downtown Vancouver is the registered tackle for 90 cash providers companies, together with 10 which have had their registrations revoked. Picture: theijf.org/msb-cluster-investigation.

Their inquiry discovered 422 Richards St. was listed because the registered tackle for a minimum of 76 overseas forex sellers, eight MSBs, and 6 cryptocurrency exchanges. At that tackle is a three-story constructing that was a financial institution and now homes a therapeutic massage remedy clinic and a co-working house. However they discovered not one of the MSBs or forex sellers have been paying for providers at that co-working house.

The reporters discovered one other assortment of 97 MSBs clustered at an tackle for a industrial workplace suite in Ontario, despite the fact that there was no proof these corporations had ever organized for any enterprise providers at that tackle.

Peter German, a former deputy commissioner for the Royal Canadian Mounted Police who authored two reviews on cash laundering in British Columbia, informed the publications it goes in opposition to the spirit of Canada’s registration necessities for such companies, that are thought-about high-risk for cash laundering and terrorist financing.

“When you’re in a position to have 70 in a single constructing, that’s simply an abuse of the entire system,” German mentioned.

Ten MSBs registered to 422 Richard St. had their registrations revoked. One firm at 422 Richards St. whose registration was revoked this 12 months had a director with a listed tackle in Russia, the publications reported. “Others look like directed by people who find themselves additionally administrators of corporations in Cyprus and different high-risk jurisdictions for cash laundering,” they wrote.

A assessment of FINTRAC’s registry (.CSV) exhibits most of the MSBs at 422 Richards St. are worldwide cash switch or remittance providers to nations like Malaysia, India and Nigeria. Some act as forex exchanges, whereas others seem to promote service provider accounts and on-line cost providers. Nonetheless, KrebsOnSecurity might discover no apparent connections between the 56 Russian cryptocurrency exchanges recognized by Sanders and the handfuls of cost corporations that FINTRAC says share an tackle with the Cryptomus dad or mum agency Xeltox Enterprises.

SANCTIONS EVASION

In August 2023, Binance and a number of the largest cryptocurrency exchanges responded to sanctions in opposition to Russia by slicing off many Russian banks and proscribing Russian clients to transactions in Rubles solely. Sanders mentioned previous to that change, many of the exchanges at present served by Cryptomus have been dealing with buyer funds with their very own self-custodial cryptocurrency wallets.

By September 2023, Sanders mentioned he discovered the exchanges he was monitoring had all nested themselves like Matryoshka dolls at Cryptomus, which provides a layer of obfuscation to all transactions by producing a brand new cryptocurrency pockets for every order.

“All of them merely moved to Cryptomus,” he mentioned. “Cryptomus generates new wallets for every order, rendering ongoing attribution to require transactions with excessive charges every time.”

“Exchanges like Binance and OKX eradicating Sberbank and different sanctioned banks and offboarding Russian customers didn’t take away the flexibility of Russians to transact out and in of cryptocurrency simply,” he continued. “In truth, it’s turn out to be simpler, as a result of the instant-swap exchanges don’t even have Know Your Buyer guidelines. The U.S. sanctions resulted within the majority of Russian on the spot exchanges switching from their self-custodial wallets to platforms, particularly Cryptomus.”

Russian President Vladimir Putin in August signed a brand new legislation legalizing cryptocurrency mining and permitting using cryptocurrency for worldwide funds. The Russian authorities’s embrace of cryptocurrency was a outstanding pivot: Bloomberg notes that as just lately as January 2022, simply weeks earlier than Russia’s full-scale invasion of Ukraine, the central financial institution proposed a blanket ban on the use and creation of cryptocurrencies.

In a report on Russia’s cryptocurrency ambitions revealed in September, blockchain evaluation agency Chainalysis mentioned Russia’s transfer to combine crypto into its monetary system might enhance its means to bypass the U.S.-led monetary system and to have interaction in non-dollar denominated commerce.

“Though it may be onerous to quantify the true affect of sure sanctions actions, the truth that Russian officers have singled out the impact of sanctions on Moscow’s means to course of cross-border commerce means that the affect felt is nice sufficient to incite urgency to legitimize and put money into various cost channels it as soon as decried,” Chainalysis assessed.

Requested about its view of exercise on Cryptomus, Chainanlysis mentioned Cryptomus has been utilized by criminals of all stripes for laundering cash and/or the acquisition of products and providers.

“We see risk actors engaged in ransomware, narcotics, darknet markets, fraud, cybercrime, sanctioned entities and jurisdictions, and hacktivism making deposits to Cryptomus for purchases but in addition laundering the providers utilizing Cryptomos cost API,” the corporate mentioned in a press release.

SHELL GAMES

It’s unclear if Cryptomus and/or Xeltox Enterprises have any presence in Canada in any respect. A search in the UK’s Corporations Home registry for Xeltox’s former identify — Certa Funds Ltd. — exhibits an entity by that identify included at a mail drop in London in December 2023.

The only shareholder and director of that firm is listed as a 25-year-old Ukrainian girl within the Czech Republic named Vira Krychka. Ms. Krychka was just lately appointed the director of a number of different new U.Okay. corporations, together with an entity created in February 2024 known as Globopay UAB Ltd, and one other known as WS Administration and Advisory Company Ltd. Ms. Krychka didn’t reply to a request for remark.

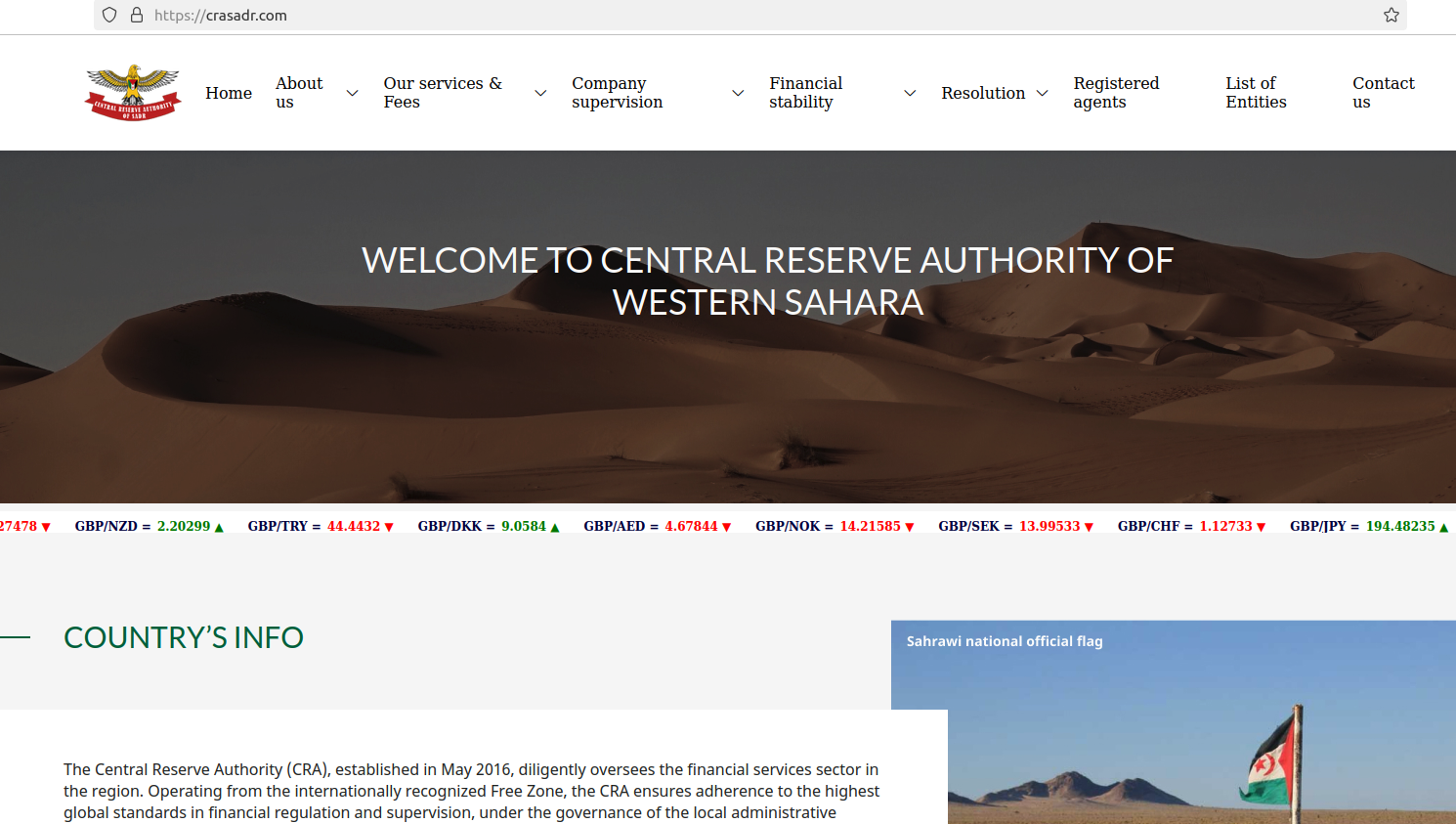

WS Administration and Advisory Company payments itself because the regulatory physique that solely oversees licenses of cryptocurrencies within the jurisdiction of Western Sahara, a disputed territory in northwest Africa. Its web site says the corporate assists candidates with financial institution setup and formation, on-line gaming licenses, and the creation and licensing of overseas alternate brokers. Certainly one of Certa Funds’ former web sites — certa[.]web site — additionally shared a server with 12 different domains, together with rasd-state[.]ws, a web site for the Central Reserve Authority of the Western Sahara.

The web site crasadr dot com, the official web site of the Central Reserve Authority of Western Sahara.

This enterprise registry from the Czech Republic signifies Ms. Krychka works as a director at an promoting and advertising and marketing agency known as Icon Tech SRO, which was beforehand named Blaven Applied sciences (Blaven’s web site says it’s a web-based cost service supplier).

In August 2024, Icon Tech modified its identify once more to Mezhundarondnaya IBU SRO, which describes itself as an “skilled firm in IT consulting” that’s primarily based in Armenia. The identical registry says Ms. Krychka is someway additionally a director at a Turkish funding enterprise. A lot enterprise acumen at such a younger age!

For now, Canada stays a pretty location for cryptocurrency companies to arrange store, a minimum of on paper. The IJF and CTV Information discovered that as of February 2024, there have been simply over 3,000 actively registered MSBs in Canada, 1,247 of which have been situated on the similar constructing as a minimum of one different MSB.

“That evaluation doesn’t embody the roughly 2,700 MSBs whose registrations have lapsed, been revoked or in any other case stopped,” they noticed. “If they’re included, then a staggering 2,061 out of 5,705 whole MSBs share a constructing with a minimum of one different MSB.”