2024 Cyber Resilience Analysis Unveils Monetary Companies Trade Challenges

New information illuminates how monetary providers leaders can prioritize resilience.

Monetary providers establishments discover themselves on the intersection of progress and peril within the quickly evolving digital panorama. The most recent information underscores that the trade-offs are vital and pose substantial dangers to monetary establishments.

Get your complimentary copy of the report.

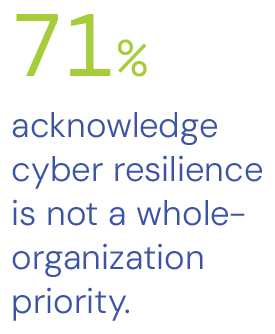

One of many foremost obstacles is the disconnect between senior executives and cybersecurity priorities. Regardless of recognizing cyber resilience as an important crucial, many monetary providers establishments wrestle to safe the help and sources from high management. This lack of engagement hinders progress and leaves establishments weak to potential breaches.

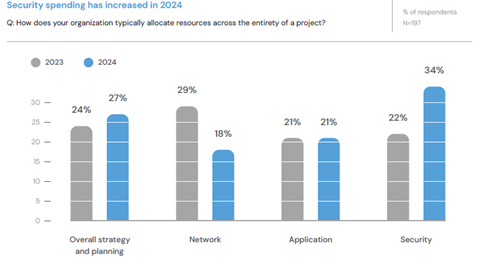

In the meantime, expertise continues to advance astonishingly, as do the dangers posed by cyber threats. The 2024 LevelBlue Futures™ Report reveals this delicate balancing act between innovation and safety throughout the monetary providers business. Our complete evaluation identifies alternatives for deeper alignment between govt management and technical groups.

The Elusive Quest for Cyber Resilience in Monetary Companies

Think about a world the place monetary providers establishments are impervious to cyber threats—the place each side of an operation is fortified towards disruptions. That is the lofty superb of cyber resilience, but it stays an elusive objective for a lot of monetary providers establishments. The fast evolution of computing has reworked the IT panorama, blurring the traces between legacy methods, cloud computing, and digital transformation initiatives. Whereas these developments carry simple advantages, in addition they introduce unprecedented dangers.

Our analysis signifies that 85% of finance respondents agree that dynamic computing will increase their danger publicity. In a world the place cybercriminals have gotten more and more refined, the necessity for cyber resilience has by no means been extra pressing. From ransomware assaults to crippling DDoS incidents, monetary establishments function in a local weather the place a single breach can have catastrophic penalties.

Exploring the Relationship Between Management and Cyber Resilience

Our survey of 1,050 C-suite and senior executives, together with 197 from the finance sector throughout 18 international locations, highlights the urgent want for cyber resilience. The report is designed to foster considerate discussions about vulnerabilities and enchancment alternatives.

Within the report, you’ll:

- Uncover why monetary providers leaders and tech groups should prioritize cyber resilience.

- Study concerning the crucial obstacles to attaining cyber resilience.

- Uncover the significance of enterprise context and operational points in prioritizing resilience.

Recognizing the Crucial of Cyber Resilience

Monetary providers leaders are referred to as to chart a course towards higher safety and preparedness. Reacting to cyber threats as they come up is now not sufficient; organizations should proactively bolster their defenses and domesticate a tradition of resilience from inside.

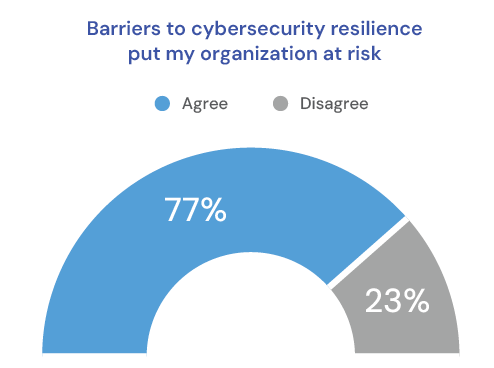

Our analysis delves into the multifaceted challenges going through monetary providers establishments of their quest for cyber resilience. From restricted visibility into IT estates to the complexity of integrating new applied sciences with legacy methods, monetary establishments grapple with deep-seated obstacles that hinder their skill to face up to cyber threats.