The ascent of algorithmic buying and selling has altered the cryptocurrency commerce area, granting merchants the freedom to automatize their methods with utmost accuracy. Now, figuring out to craft a crypto grid buying and selling bot growth could be considered one of your most proficient expeditions for capitalizing on market fluctuations. This information explores the basics of grid buying and selling bots, their design, & optimization highway maps.

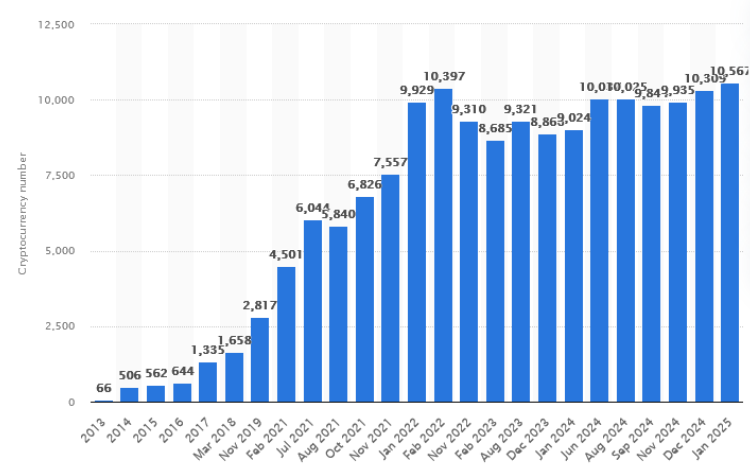

Quantity of crypto coinage across the globe, 2013-beginning of 2025, Statista

What’s a Crypto Grid Buying and selling Bot?

Beginning right away, let’s unmask the subject’s geometry. A crypto futures grid buying and selling bot is an automatic buying and selling instrument which locations purchase & promote placements at predetermined value layers inside a buying and selling extent. By seizing the cryptocurrency market tendencies, it trades persistently. Spawning earnings from value fluctuations is the dominant goal.

Therefore, it might promote orders at particular costs to adapt to altering market situations.

Overview of Grid Buying and selling in Cryptocurrency

Extra in-depth, grid buying and selling is a mechanic that splits a settled value vary into a number of ranges, making a grid of purchase & promote orders. The scheme is related in unpredictable and completely different market instructions, the place costs fluctuate inside a set vary, offering a steady earnings from small value fluctuations.

How Grid Buying and selling Bots Simplify Crypto Buying and selling

Due to this fact, grid buying and selling bots robotize these methods, neutralizing the exigency for hands-up order placement. Briefly, the methods fasten up crypto buying and selling bot methods by way of revenue from present market value strikes:

- Escaping human errors with its’ grid of orders

- Perform trades continuous—24/7

- Swift market swings’ response

- Demote emotional buying and selling verdict

- Adjusting the grid

Crypto Grid Buying and selling Bot Improvement: The way to Create and Optimize Your Bot

Diving into the crypto grid buying and selling bot growth course of, let’s disclose the specialties of its saturated menu and the market avengers.

Why Select Grid Buying and selling Bot Improvement?

Growing a grid buying and selling bot boosts an organization with unseen buying and selling perks & bonuses. Whether or not for personalised utilization or utilized as a business app, a well-crafted buying and selling app may noticeably intensify buying and selling productiveness & simplicity. Making the most of market fluctuations, it pulls revenue from small value fluctuations by shopping for in response to value variations between completely different market strikes.

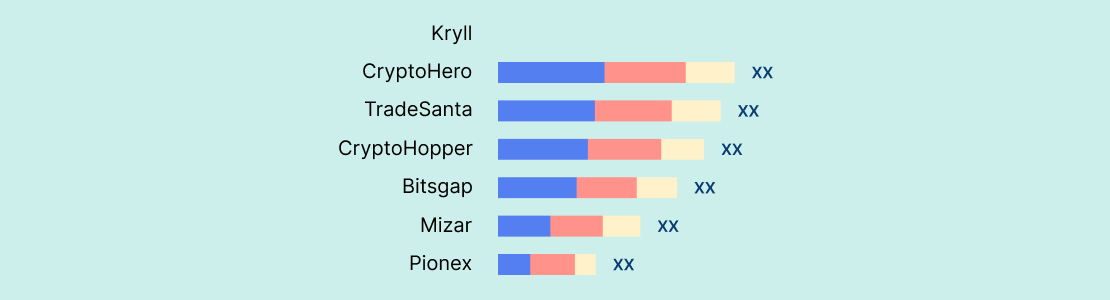

Plunging into the world of crypto buying and selling, the next merchandise emerge as the highest hitters:

Plunging into the world of crypto buying and selling, the next merchandise emerge as the highest hitters:

Dominant gamers of the crypto buying and selling area, February 2025, Marketresearchintellect

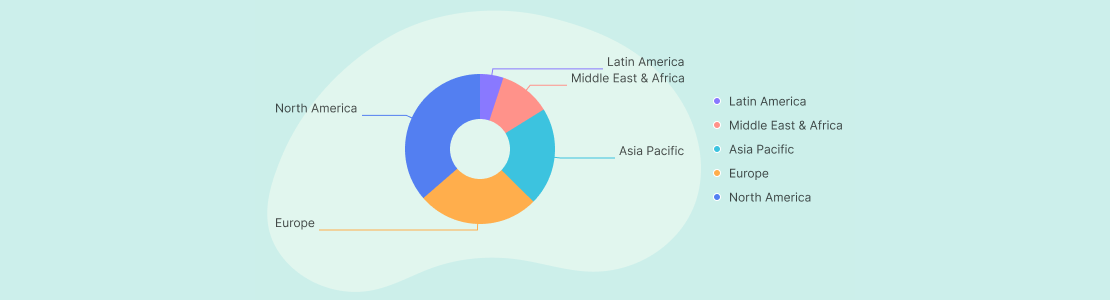

The event areas are like beneath:

Crypto buying and selling bots’ growth mart geography, February 2025, Marketresearchintellect

Advantages of Growing a Grid Buying and selling Bot for Cryptocurrency

Because the crypto grid buying and selling bot growth boons, seize the upsides listed to assist your organization amplify:

- Automatized buying and selling selections for passive earnings

- Swifter commerce when against buying and selling by hand

- Administering numerous buying and selling pairs concomitantly

- Diminishing buying and selling perils by way of systematized accomplishment

Key Options of a Effectively-Designed Grid Bot

A totally performing grid buying and selling bot ought to receive attributes to witness knowledge shielding & expediency. Due to this fact, these parts shall bump up as centerpiece items of a rigorously calibrated grid buying and selling app, potent to reap the benefits of value fluctuations:

- Adaptability in grid spacing: with it, merchants personal the freedom to adapt grid ranges vigorously based mostly on the mart conduct, inserting optimum purchase & vend placements.

- Halt loss & catch revenue mechanics: it governs market perils robotically by tracing thresholds. So, you’ll be able to escape shedding trades & blocking in income at predefined tiers.

- Fixed market inspection: with the help of embedded AI & ML procedures, this device scans historic tendencies & market emotions to amend judgments.

- Many-notes change chance: it witnesses a number of cryptocurrency swaps, granting merchants energy for prolonged market entry & multiplied probabilities for gross sales.

- Automated operation and inserting offers: with uninterrupted, swift, & carrying orders totally, merchants’ productiveness ameliorates, producing income.

- Backtesting & imitation: it’s the place merchants can proof-test the grid buying and selling procedures in pretend environments earlier than going precise, guaranteeing threats’ minimization.

- Vigorous options for threat administration: with trailing halt losses & grid rebalancing, it’s easy to acclimate because the market fluctuates.

- Consumer-friendly format: it grants intuitive dashboards with visualization devices, making merchants potent to manipulate operations & set up preferences.

- Safety & compliancy: this trick implements encryption, API key safety, & compliance yardsticks for retaining consumer funds protected & for regulatory adjustment.

- Reminders & alerts: it retains merchants up to date with market conduct, backing up a bot with precise alerts & notices.

Why Work with a Grid Buying and selling Bot Improvement Firm?

Skilled builders present:

The way to Create a Crypto Grid Buying and selling Bot?

So, approaching the essence of the weblog, let’s reply the key query of the article—learn how to create a crypto buying and selling bot?

Added to this assertion, there’s some historic knowledge by Statista as to the cryptocurrencies’ fluctuations and prospects.

Cryptocurrencies’ value actions, January 30, 2025, in $ U.S., Statista

Observe a number of overriding crypto grid buying and selling apps to take as a positive illustration in your crypto grid buying and selling technique:

- Pionex boasts decreased buying and selling charges & 16 free buying and selling bots.

- Bitsgap with manifold-swap assist (Binance, Kraken, KuCoin).

- Binance Grid Buying and selling Bot, becoming for high-frequency customers & that includes Binance Futures incorporation.

Important Steps in Grid Bot Improvement

- Outline buying and selling traits. It implies deciding on grid spacing & halting losses.

- Growing a buying and selling scheme entails working the logic for an automatized purchase/promote process.

- Embed APIs, relating the bot to cryptocurrency swaps.

- Implement a strategy, witnessing that the bot acts inside shielded buying and selling boundaries.

- Test your bot in synthetic settings: it ameliorates productiveness earlier than stay deployment.

Selecting the Proper Instruments and Applied sciences for Improvement

- Programming languages embody: Python and JavaScript, with C++ for back-end logic on board.

- Alternate APIs: Binance, Coinbase, Kraken, and many others.

- Administering databases: for retaining buying and selling knowledge in repositories.

- ML: TensorFlow or PyTorch—for predictive evaluation.

Implementing the Grid Technique for Environment friendly Buying and selling

Shifting additional, let’s gaze into the following growth tier:

- Firstly, set up a value array by dividing it into grid ranges.

- Secondly, find your purchase orders within the bot at predefined grid inferior layers.

- Thirdly, find promote orders within the bot at predetermined inflated layers.

- Lastly, adapt grid layers to an unpredictable diploma, as per the market scenario.

Superior Options for a Profitable Crypto Grid Buying and selling Bot

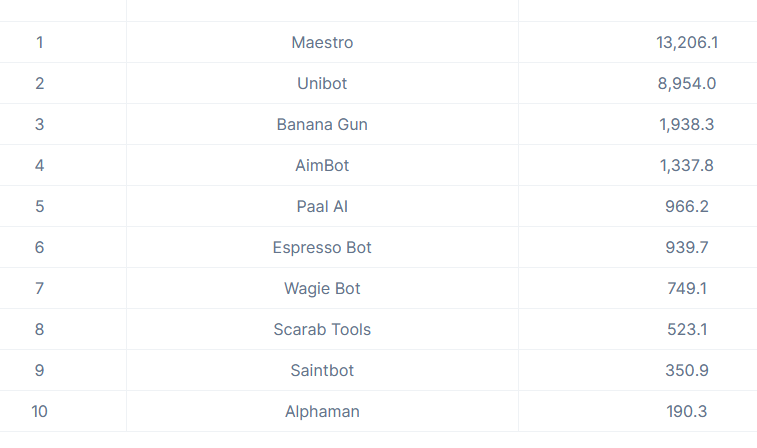

Sharpening your crypto grid buying and selling bot with refined options guarantees your small business bettered decisional processes & consumer information’ security. Look now on the most progressive bots within the area to understand motivation & pull benefit of value variations:

Champions in bots area, December 2023, Coingecko

Now, have a look at the progressive enhancements to think about turning your crypto grid buying and selling bot growth right into a twister of boons.

Automated Market Evaluation and Resolution-Making

- AI-powered buying and selling imaginative and prescient: right here, machine studying fashions study historic and real-time information to pinpoint favorable buying and selling routes.

- Sentiment examination: the characteristic employs pure language processing (NLP) mechanics to drag market conduct from information, social networks, and many others.

- Adaptive buying and selling methods: with this piece launched, your bot units the grid settings based mostly on market tendencies.

Integration of Cease Loss and Take Revenue Mechanisms

- Tracing stop-loss adapts to stop-loss layers with the asset value shifting in a constructive course. This transfer extraordinarily stokes your income with diminished losses.

- Take-profit tiers grant regular revenue by being locked in by setting predetermined factors.

- Cease-loss mechanisms allow sellers to use market volatility pointers to repair optimum limits.

Customization Choices for Consumer Preferences

- Elastic grid acclimation is the place merchants independently fine-tune grid distance & place orders for diversified market conduct.

- Multi-asset backup grants buying and selling prospects inside a number of crypto coinage scattering & buying and selling pairs concomitantly.

- Peril governance settings established by merchants—this promising tip permits brokers to configure the spot sizing, leverage, & loss alleviation routes.

- Actual-live reminders & alerts—upgrades are despatched to customers on market conduct, carried out trades, & present metrics by way of in-app reminders, and many others.

- By embedding these heavy-weight progressive options into your crypto grid buying and selling bot, ship a extremely operative, adaptable, & safety-boosted resolution.

The way to Optimize Your Grid Buying and selling Bot for Crypto Markets?

Shifting nearer to the ultimate stage of our storyline, let’s replicate on augmenting productiveness with progressive AI parts. Don’t overlook the stage!

Adjusting Grid Ranges for Market Volatility

Let’s now see extra highly effective strategies to show your crypto grid buying and selling app right into a cash-bringing twister.

- Changeable grid modifications. So, set grid ranges that increase based mostly on real-time market volatility, lowering fragility to sudden value alterations.

- AI-based prognosis. This piece avails from ML & dives into historic information to current optimum grid width based mostly on latest drifts.

- Adaptive buying and selling ranges. Right here, you’re suggested to invoke robotized changes to the buying and selling in response to value shifts and preserve the technique.

Optimizing Purchase and Promote Orders to Maximize Revenue

Concerning extra stable revenue augmentation, listed here are superior tips to facilitate the crypto grid buying and selling bot growth.

- Sensible order achievement. Now, select to use algorithms modifying buy-&-sell instructions in a changeable method.

- Slippage governance. Problem as much as shrink the value slippage, implying inserting restricted orders, not market orders. It guarantees extra detailed execution.

- Rationalizing charges. Alter commerce sizes & regularity to lower transaction prices, growing internet revenues progressively.

Steady Monitoring and Efficiency Analysis

With this remaining contact, regulate to extra uninterrupted surveillance of the worthwhile crypto grid buying and selling bot:

- Tracing real-live execution. Enact instrument panels with stay analytics on commerce victory ratio, market conduct, & revenue boundaries.

- Backtesting strategies & approaches. Right here, always check miscellaneous grid shapes in synthetic settings.

- Robotically reporting efficiency. This final characteristic scans trades held & suggests refinements, certifying operating amelioration of buying and selling routes.

By making use of these optimization avenues, merchants will maximize profitableness by threat mitigation, retaining grid buying and selling bots rivalrous in monetary markets.

Why Accomplice with a Grid Buying and selling Bot Improvement Firm?

As we strategy the final stretch of the highway on our voyage throughout the crypto grid buying and selling bot growth, could we authorize ourselves to current you SCAND, a stable software program firm with long-standing experience & an knowledgeable crew.

Inevitably, designating an knowledgeable crew for growth enhances your bot’s productiveness & its knowledge safety. So, draw close to & rigorously take into account some insights.

SCAND’s Experience in Crypto Grid Bot Improvement

Subtle builders clearly comprehend all algorithmic buying and selling’s specificities and supply strong coding, AI integration, & optimization companies.

Like right here, SCAND’s skillfulness reaches far, presenting cutting-edge expertise & craftsmanship to make companies shine.

Tailor-made Options for Completely different Buying and selling Wants

A custom-built bot can victual to particular buying and selling routes & threat tiers, crafting fruitful bonuses and perks.

That will help you succeed, SCAND delivers crypto buying and selling companies like:

- Integration companies for arbitrage bots

- Tailor-made crypto arbitrage bot options

- Embedding Bot-as-a-Service

- Professional consulting in your arbitrage wants

Ongoing Assist and Upkeep for Your Bot

Uninterrupted assist ascertains safety updates, bug mends, & breakthroughs, retaining your bot immediate in changeable market fluctuations.

Challenges in Crypto Grid Buying and selling Bot Improvement

As a ending spherical, crypto grid buying and selling bot growth emerges with some obstacles. These glitches declare for precise planning, grounded tech experience, & threat tolerance methodology.

Catch on among the urgent constraints getting on the highway of crafting your crypto grid buying and selling bot. Hereby, memorize learn how to sort out them:

Addressing Technical Points Throughout Improvement

- API integration complexities. Guaranteeing well-performed connectivity with crypto exchanges will be strenuous as a result of diverging API buildings & price limitations.

- Retardations & productiveness rapidity. Bots should execute trades on-line to develop on market fluctuations, requiring immediate code optimization.

- Thoroughness of algorithms. Growing an unbreakable buying and selling routine successfully following the grid technique with out extreme leakages.

- Scalability hiccups. As buying and selling capability expands, assure the bot runs giant datasets & executes placements effectively.

Managing Dangers Related to Grid Buying and selling

- Market changeability. Sudden value shifts can break the grid technique, inflicting unintended leakages. Implementing AI-driven volatility detection helps escape dangers.

- Overtrading & charges. If a bot executes offers, transaction prices may have an effect on earnings.

- Liquidity hiccups. Low flowability in some buying and selling pairs turns into slippage.

- Unpredictable market clashes. Speedy market downturns execute a number of purchase placements with out corresponding merchandising alternatives, rooting capital lock-up.

Guaranteeing Safety and Compatibility

- Cyber risks. Encrypting, API key safety, & safe authentication mechanisms are urgent.

- Regulatory adherence. With an ample stack of jurisdictions in buying and selling, attempt to adjust to the frameworks.

- Information privateness. Safeguarding consumer information & buying and selling methods stay confidential is constitutive for safeguarding merchants’ reliance.

- Stopping exploits. Lastly, implementing safety audits & testing mechanisms to flee loopholes & unauthorized entry.

The way to Get Began with Crypto Grid Buying and selling Bot Improvement?

Terrified about launching a brand-new app? Fear not, as a rigorously packed grid buying and selling bot requires a structured methodology. Simply keep placid & learn additional.

Steps to Launch Your Personal Grid Bot

- Outline targets & technique. Decide the buying and selling objectives, most popular pairs, threat allowance, & market sentiment that your bot performs with.

- Choose the acceptable growth devices. Choose the becoming programming languages (e.g., Python, JavaScript), frameworks, & APIs harmonizing with the bot’s necessities.

- Develop the essential buying and selling algorithm. Carry the grid buying and selling routine, incorporating parameters like grid spacing & commerce execution logic.

- Combine with cryptocurrency swaps. Tie the bot with switches like Binance, Kraken, & Coinbase by way of API integration.

- Perform options to manipulate threats. Dynamic stop-loss & trailing stop-loss orders to protect knowledge towards additional losses.

- Take a look at in synthetic environments. Run backtesting with historic information & paper buying and selling in stay situations to refine the bot earlier than actual deployment.

- Optimize for expediency. Look at bot efficiency, regulate parameters based mostly on market conduct & incorporate AI-powered tips for smarter buying and selling verdicts.

- Again up knowledge safeguarding & compliance with pointers. Implement encryption and safe API key storage, by complying with regulatory pointers to protect consumer funds & information.

- Deploy and monitor stay buying and selling. Launch the bot with a managed capital allocation, repeatedly observe its progress & produce modifications for optimum outcomes.

- Present fixed assist & upgrades. Steadily replace the bot with market refreshments for safety updates, profitability, & characteristic modifications.

Choosing the Proper Improvement Staff

Cooperating with skilled blockchain engineers ensures the bot meets efficiency, security, & compliance pointers.

Key Concerns for Lengthy-Time period Success

- Common software program add-ups

- AI-powered ameliorations

- Optimizing productiveness

- Information security

- Sturdy threat governance

- UI & customization

- Overarching backtesting & stay testing

- Buyer assist & group inclusion