For a startup, small, or medium-sized enterprise, crafting a safe cellular banking app is a daring effort.

Let’s scan the strikes, knots, & good recommendation entailed in crafting an app that meets the necessities of nowadays’ banking customers.

So, digital commerce mart exhibits that uppermost earnings suppliers in digital banking per capita are the U.S., United Kingdom, Japan, and Germany.

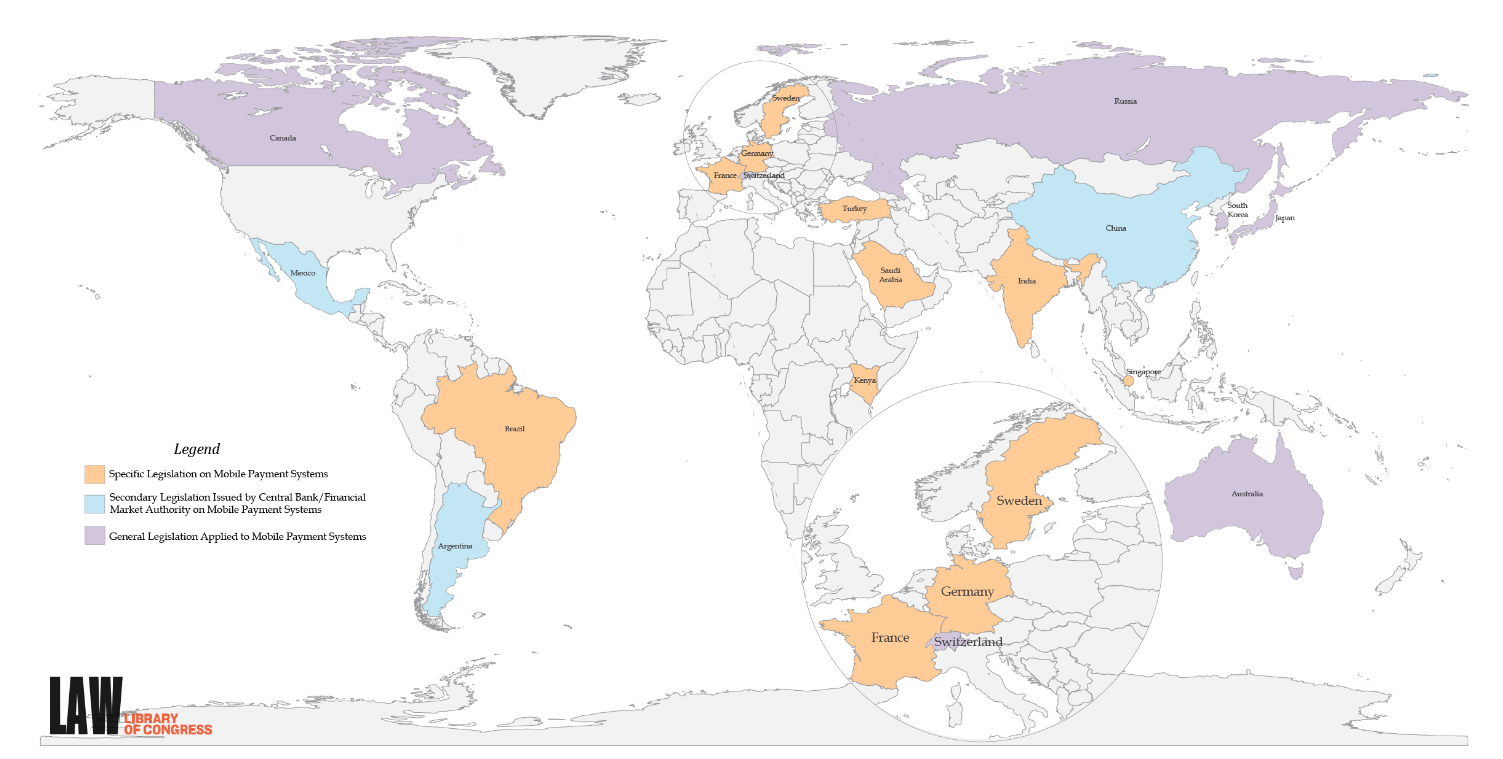

Concerning cellular fee techniques regulation, the U.S. Library of Congress report cites some insightful knowledge on a number of nations.

Accordingly, from 2019 on, on-line banking funds have been modified into extra progressive money operations. In Germany, one of many world pioneers within the finance and engineering improvement sector and G7 state, in 2019, 9 out of 10 folks possessed smartphones, and simply 7% utilized for them to settle up.

As we embrace a broader political territory—the G7, its digital banks market, as Statista claims, is projected to progress to U.S. $0.59tn quick ahead to 2025.

With the above broad analysis knowledge, our all-inclusive weblog analyses the necessities of cellular app improvement, entailing core specifics, finest strategies & tendencies, with very important safety visions.

Introduction to Cellular Banking Apps

In 2025, a seamless, well-projected cellular banking software program with uncompromised knowledge can elevate UX & raise person confidence, drawing unmatched enterprise openings.

Being a startup proprietor, a small agency, or a long-standing enterprise, making a guarded & user-friendly banking answer is your nice presentation.

However what to use to maintain a banking product frontline and guarded by way of person safekeeping? And find out how to implement them for the product to yield good points for commerce? Let’s ponder intimately.

So, this course of paid apps within the banking business signifies the way in which customers want to implement budgeting actions on smartphones, like scanning financial savings & translocating them, paying checks, & even investing—with out visiting financial institution subsidiaries or ATMs, inside your pocket attain. For startups, elaborating on smartphone-paid software program it’s not a tech vogue, but, a clever shift for displaying higher companies, retaining consumers, & staying needful.

Digital banks (a.ok.a. Neobanks) are prospering because of the cyber tech upsurge & shifting buyer preferences. Millennials and Zoomers energy the drift, with neo-banking channels outdoing others by furnishing consumers with snacks in cellular functions.

Balancing the banking apps & precise fintech experience, strong startups and SMEs elevate inner procedures & need to create safe & intuitive cellular companies in banking.

Key Options of a Cellular Banking App

Coming nearer, what are the differences that may entice folks to a financial institution app, retaining them completely happy? Learn a weblog to learn to construct a banking app.

Clearly, when growing cellular banking software program, it’s essential to focalize each performance & security. Let’s disclose all-important top-gear banking software program components.

1. Consumer file administration. Keen to safe clear operations & endorse consumers to remain up to date concerning the price range, incorporate choices of:

- Stability checks to observe guests’ exercise.

- Transaction historical past’s view for detailed data to trace spending.

2. Funds transferral & funds. An possibility of shifting money swiftly & danger-free, therefore, integrating the next capabilities into the app:

- Peer-to-peer funds for fast transfers to mates or connections.

- Invoice funds—to affiliate with suppliers for automated funds.

- Worldwide transfers for cash cargo throughout states.

3. Invoice funds & recurring transactions. Allow shoppers of the cellular answer in banking to maintain abreast with funds through:

- Utility invoice fee choices like electrical energy or Web.

- Scheduled funds for recurring payments or subscriptions.

- Reminders for upcoming happenings or essential appointments.

4. Safety features. Whereas coping with frangible person data, implementing strong securing occasions is compelling for cellular banking innovations. Highlighting this shielding function in your app strengthens guests’ dependence & ensures you’re sticking to regulatory norms. It contains:

- Biometric login (fingerprint or entrance detection) for swift & protected entry.

- Multi-factor verification to defend accounts with further protecting loops.

- Finish-to-end ciphering for knowledge safety.

- Transaction alerts for uncertain actions.

5. Budgeting and monetary planning instruments. Customers from 2025 and forward use on-line banking companies that go additional than primary features. Including customized money data can increase person retention. Think about making use of efforts that:

- Comply with up on bills and conduct prices’ categorization.

- Save objectives and visually hint these developments.

- Conduct AI-driven insights & recommendation to spice up customers’ energy over funds.

6. Buyer assist. As useful assist builds dependence & improves person retention, mirror on furnishing fast and high quality buyer help inside the app. Some occasions to combine:

- 24/7 chatbot for common requests.

- On-line chat for extra subtle queries.

- FAQs chapter for self-service and chatbot assist.

7. Card administration. This software grants clients energy over the playing cards, thus, pushing up the cellular banking functions protection. Embrace on this chapter:

- Fast activation or deactivation of a card.

- Establishing spending restrictions.

- Helpful on-line funds.

- Card-less ATM pullouts by QR code scanning.

8. Reminders & alerts. This perform of constructing a cellular banking app answer retains clients retained, making guests return. Allow the next positions:

- Notices for all sorts of cellular banking app transactions.

- Reminders for low balances or shut dates to return.

- Personalized cash insights or bonuses.

9. Integration with third-party companies. Don’t miss this clean property of your cellular banking creation. This manner, grant the cellular app in banking sweeping attributes & incorporate these celebrated third-party servings:

- E-commerce digital websites for checkout paying.

- Kits for tax management.

Steps to Create a Cellular Banking App

When venturing into fintech app improvement and questioning find out how to create a banking app, the event course of includes the voyage throughout applied sciences & levels of smartphone banking software program creation.

Thus, making a cellular banking app includes a number of chapters, from planning to execution. Right here’s a concise define of the needful levels concerned.

Outline Your Targets and Goal Viewers

Earlier than beginning to craft a cellphone banking answer, it’s binding to painting an app’s viewers & goal precisely:

- Who’re your closing shoppers?

- What drawback does your cellphone banking software program handle?

- What performance will distinguish your answer from the challengers?

Conduct Market Analysis

Detailed rivalries’ scrutiny of your cellular banking software guides you in scanning gaps with events for crafting a cellular banking software program. Therefore, deal with tides, person likings, & contestants’ gaps and provisions. Analysis into:

- Future app performance.

- Contestants’ perks and downsides.

- Customers’ difficult facets that your software program might resolve.

Design the App Structure

- Floor upon wireframes’ creation and the elemental construction of your cellular banking invention.

- Plan the person journey, giving an intuitive login-transactions’ steam.

Develop Cornerstone Performance

- Begin by growing constitutive banking options like person data management, transferring money, & safety occasions.

- Consider constructing a sturdy back-end with integration into banking techniques, fee gateways, & safety protocols.

Select the Proper Tech Stack

That is in all probability the pivotal baseline in devising your cellular banking platform. By choosing a language or database that unsuits the performance calls for, you might damage all of the preliminary undertakings carried out.

So, keep put to pick the proper engineering stack to your fintech app productiveness and credentials’ safety. Mull over your tech funnel to align along with your e-banking software program complexity & productiveness wants:

- Entrance-end improvement. React Native, Flutter, or native languages for Android and iOS—Kotlin and Swift.

- Again-end. Node.js, Django, or Java (Spring Boot) for a scalable and safe back-end. Apply Swift or Kotlin programming languages for native improvement / React Native for cross-platform options.

- Databases. Combine PostgreSQL, MongoDB, or Firebase platforms—for balanced knowledge administration.

- AWS or Google Cloud internet hosting—for scalable infrastructure.

- Lastly, combine banking & fee APIs—for enriched performance.

Implement Safety Options

Digital protection isn’t the primary, but, foremost attribute of your cellular app improvement course of. Thus, implement passes to defend person profiles throughout transactions:

- Information encryption for delicate knowledge. Guarantee end-to-end ciphering for safe communication and token-based authentication for safe hold-outs.

- Two-factor authorization (2FA). Add a supplemental tier of security.

- Regulatory compliance. Cling to the area tips like GDPR.

Design an Intuitive Consumer Interface (UI)

Crafting high quality UI options for a cellphone banking software program product might outline your app’s victory vs collapse. That is why entrepreneurs are emboldened to hew to uncluttered, visually engaging packaging to let guests easily browse their cellular paid platform. Furthermore, maintain mockups & prototypes current for suggestions earlier than improvement.

Floor your work upon:

- Simplicity—to keep away from chaotic interfaces, introduce clear visuals & tags.

- Consumer accessibility—to make sure the app is purposeful for disabled individuals.

- Uniformity—to render a very coherent app look.

Develop Pivotal Options

As you’ve formed up your financial institution cellular product visible design, go on by constructing your cellphone banking software program functionalities. Right here is a few fruitful recommendation: begin constructing your cellular app in banking with a Minimal Viable Product to check core options with an app improvement firm earlier than including superior ones.

Moreover, your dream app’s in-built features embody:

- Account administration to watch the person’s account money and transaction file.

- Cash switch to visualise person-to-person & interbank transactions.

- Card dealing with: rapid activation, deactivation, & spending restrictions.

- Notifications: real-live transactions’ warnings or quick balances.

- Safety: biometric ID and fraud recognizing instruments.

Take a look at and Optimize Rigorously

Conduct check-ups to vow your app performs flawlessly throughout platforms and eventualities. See under assorted methods of testing:

- Optimize the app for efficiency, establishing its fluent operation on an ample number of home equipment & platforms, by rapidly managing excessive loading.

- Performance & usability testing: confirm all options work as supposed being centered on performance, safety, and usefulness. Strive testing the cellular banking answer in your mates or connections.

- Safety testing: determine & restore fragilities.

Launch and Iterate

Because the checking is accomplished, start these procedures:

- Launch the app to the app shops.

- Stack up person suggestions & maintain refining the m-banking answer based mostly on real-world adoption.

- Launch a advertising and marketing initiative & mainstay the product.

- Think about delivering tutorials for newcomers.

Collect Suggestions and Enhance

Clearly, fixed app refinement & on the lookout for perfection retains it highly effective within the cyber mart. Publish-launch, search person opinions with noting spheres for elaboration in a cellular banking answer. Therefore, maintain be aware of those options:

- Restore errors and ameliorate efficiency.

- Style new features based mostly on person response.

- Maintain on to the latest OS updates.

Safety Concerns in Cellular Banking App Improvement

At present, cellular banking software improvement innovations land in each pouch, with cellular system paid software program being each teenager’s routine. Nevertheless, with cyber risks raised, constructing a dependable app is a pivotal enterprise for startups & small corporations, coming into the fintech sector.

Plunging into the under safety concerns will assure your cellular app in banking each meets regulatory requirements & earns person belief.

Definitely, safety is an uppermost choice for cellular banking app improvement. Cellular apps in banking deal with delicate monetary knowledge, so any vulnerability can result in catastrophic penalties resembling big monetary losses resulting from direct theft or fraud with compromised accounts, and injury to your model. It implies buyer belief loss with doubtlessly years to rebuild, and authorized penalties for not complying with laws.

Due to this fact, to flee all financial hurricanes, take care and persist with the important thing safety provisions under:

Finish-to-Finish Encryption

Information encryption converts delicate person credentials into unreadable bits’ threads. This move ensures your data’ being stored untouched even as soon as intercepted.

- Assure that every one communication contained in the software program & its server is encoded through SSL-type packages.

- It aids in shielding breakable data from hazard.

- Use end-to-end encryption to defend person knowledge on the route from the person’s system to the server.

- Implement AES-256 encryption—a gold customary for safeguarding knowledge.

Two-Issue Authentication (2FA)

MFA provides security boundaries by asking shoppers to substantiate profiles by a number of routes. Thereby, it decreases the chance of unverified entrance even with one endangered tier within the cellular banking software:

- Preparatory tier—password.

- Biometric affirmation like face scanning—for additional shields.

- Implement 2FA to spice up a login defend. It would suggest SMS-based affirmation or authentication apps.

- One-off passwords, despatched by SMS—for dynamic safety.

Going forward, let’s observe different main routes for making your cellphone banking software program run like a clock mechanism.

Safe APIs

Right here, these are urgent for connecting your banking software program to 3rd events like on-line paying results. With unsecured API as a standard assault level, memorize to supervise:

- Utilizing Auth 2.0 for safe authorization.

- Often updating API keys & entry tokens.

- Implement fee limits to keep away from API abuse.

Common Safety Testing

Thought-out testing pinpoints fragilities and solves them earlier than assaulters would possibly exploit this state of affairs within the banking expertise:

- Conduct penetration checking & act like actual assaults.

- Maintain code opinions to determine breakable coding pathways.

- Make use of an automatic package for fragility viewing.

Fraud Detection Mechanisms

Progressive rip-off discovery techniques examine and stop uncertain actions on the air.

- Introduce AI-driven fraud scanning for non-typical behaviors.

- Make use of transaction monitoring techniques for harmful actions.

- Launch geofencing transaction limits from uncommon spots.

Compliance with Rules’ Frameworks

These safety techniques embody:

- PCI DSS—to handle digital transfers.

- GDPR—to maintain the EU knowledge protected.

- PSD2—to raise dependable fee strategies in Europe.

Rules on cellular banking functions techniques in chosen states, 2020, Legislation Library of Congress

Safe Storage

Preserve delicate knowledge like guests’ particulars through encryption methods & instruments like Keychain (iOS) to defend credentials & keys.

- Apply tokenization to interchange frangible knowledge with incomparable tokens.

- Retailer crucial data on protected, server-side settings.

- Create encoded backup copies to safe data-saving.

Actual-Time Alerts and Notifications

Preserve customers knowledgeable of the occurring strikes by flash alerts.

- Notify customers of login makes an attempt from new units.

- Ship transaction affirmation alerts for added oversight.

- Grant customers allow to report uncertain actions straight by the app.

Actual-live reminders give customers time to behave promptly in case of considerations.

Biometric Safety Options

Fashionable cellular devices assist biometric applied sciences like thumbprint viewing & face authorizing. These present:

- Enhanced safety. Biometrics are particular to every person and onerous to vogue.

- Comfort. Quicker and easier than conventional password entry.

- Compliance increase. Matches to safety necessities for frangible functions.

Cellular Banking App Design Greatest Practices

Stepping alongside this manner, the following purpose is revealing the optimum phases in cellular banking app creation. Thus, lookup find out how to use cellular banking software program tips.

Simplicity and Readability

As cellphone banking software program should make all-embracing enterprise duties pure, there’s no level in overloading customers with extreme data:

- Escape muddle to determine an intuitive interface.

- Craft core balances and transactions’ visualization on the eye tier.

Consumer-Centered Interface

- Design the app to correspond to the goal group’s preferences, contemplating assumed habits & liking.

- Lower the quantity of actions your customers ought to do for a transaction (e.g., transferring cash).

Responsive Design

- A responsive interface certifies to your shoppers a clean & secure searching journey on all screens & dimensions utilized.

Interactive Parts

- Use partaking components like animations & changeovers to information guests alongside the duties.

- Nevertheless, attest these don’t retard the app’s productiveness.

Accessibility

- Incorporate elements like voice requests, high-contrast UI choices, & display screen compliance.

- Attempt to enrich your app with useful functionalities for customers with handicaps.

Monetize Your Cellular Banking App

Monetizing a cellular answer in banking is significant to maintain it abreast. Take a look at a number of potent methods to provide revenue from the cellphone banking software program:

Transaction Charges

- Charging small charges for every deal like wire funds, worldwide remittances, or paying payments emerges as a normal income supply.

- You might also cost fastened charges, in accordance with the kind of deal.

Premium Providers

- Furnish the cellular banking answer with premium choices like particular person spending recommendation, progressive budgeting kits, or increased transaction restraint for subscription expenses.

- You may additionally cost for entry to fiscal companies like loans or deposit companies inside your product.

In-App Promoting

- Whereas offering helpful choices, you would possibly incorporate promoting alternatives. Cooperating with third-party enterprises to current related, non-intrusive commercials ends in successfully capitalizing on an app.

- Adverts is also situated based mostly on buyer habits, like selling new choices to customers and displaying preferences in corresponding placements.

Affiliate Packages

- Cooperating with different insurance coverage, funding enterprises, or mortgage bureaus for affiliate promotional packages is one other trick to achieve revenue.

- By recommending companies by your banking answer, earn a cost for each well-resulting suggestion.

Information Insights

- When you personal an ample buyer catalog, right here’s a hack: profit from anonymized data to promote insights for market surveys.

Summing up, monetizing your app whereas preserving person reliance grounds upon worth & person knowledge safety. Being supplied extra invaluable companies, clients lean extra in direction of paying for these invaluable choices.

Challenges in Growing a Cellular Banking App

Naturally, making a cellular answer in banking is a considerate enterprise. It implies tech complexities, perils in credentials’ shielding, & fixed regulatory overseeing. Let’s examine the frequent constraints an entrepreneur would possibly meet:

Safety and Information Safety

- Since banking apps deal with frangible buyer credentials, it’s a move muster to grant this data the supreme shielding—since laptop cyber assaults like hacking & knowledge loss have an effect on your app.

- Growing strong encryption protocols, securing person authentication with multi-factor authorization (MFA), & making use of end-to-end ciphering are pivotal passes to defend person credentials.

Regulatory Compliance

- Smartphone-paid apps should conform to fiscal norms like GDPR for fee security, being particular to the placement in view.

- Implement these laws and constantly supervise & improve them.

Consumer Expertise (UX) and Interface (UI) Design

- Crafting an interesting app that switches intrinsically into person habits and is easy to make use of is the bedrock of crafting your app. Mainly, a poor interface simply frustrates clients & ends in them scaring out of your app.

- Customers count on seamless navigation, straightforward fund reallocation, & real-time bulletins with out delays.

Scalability and Efficiency

- Your cellular banking answer should deal with excessive a great deal of offers with out productiveness lags. With increasing buyer data, highly effective scaling ought to happen.

- Optimizing back-end infrastructure and utilizing cloud options bolsters the app’s amplification in customers & performance.

Integration with Banking Methods

- A large number of banks function on old-school techniques that don’t at all times adjust to current-age banking cellular app improvement practices.

- Backing clean integration with banking databases, fee companies, & extra is usually a critical puzzle nevertheless it’s a purposeful app’s cornerstone.

How SCAND Can Assist You Construct a Safe and Environment friendly Cellular Banking App

SCAND is likely one of the trusted app builders that create safe, user-friendly digital cellular software program for banking, logistics, warehouse assist, and so forth. With 25+ in workplace with fintech options & extra, our improvement group understands the complicacies of devising apps within the banking sector & the worth it prompts.

By following our handbook’s ideas and steps outlined, get on a promising lane of initiating an app through assembly the requests of the present digital banking area.

So, why select SCAND?

- Confirmed safety data. Therefore, we settle right down to safeguarding the audience at each tier of devising the app. From safe login options like bio-metrics to E2EE, our specialists impeccably defend your data.

- Customized options. Our specialists completely mix every enterprise with its viewers’s calls for. This manner, we furnish our clientage with made-to-order app solutions that mix with particular regulatory & person expectations.

- Flawless integrations. We now have expertise working with legacy options & can incorporate your app easily with outer fee companies, & extra.

- UI/UX excellence. The SCAND’s improvement crew creates visually attractive, persuasive & intuitional UI—to make the app comprehensible for shoppers even with no tech familiarity.

- Scalability and Productiveness. Being a compact startup or an authoritative financial institution, SCAND ensures your cellphone banking software program amplifies seamlessly and handles excessive transaction load.

We run in tandem with our shoppers to ship high-quality apps on time & inside your budgetary vary, all guaranteeing top-notch knowledge security.

Conclusion

Cellular apps in banking are quickly changing fiat cash. For startups & SMEs pursuing to enter the fintech realm, it’s determinative to create a safe, user-aimed answer enriched with progressive performance.

By focusing on core options like knowledge security, ample interface, & strong tech choices’ stack, stake in crafting cellphone banking software program. Bear in mind to defend the data and allow seamless use of the software program.

So, by greedy these chief monetization facets, tackling frequent issues, & capitalizing on expert-level companies, begin constructing a cellular banking answer assembly clients’ calls for.

FAQs

FAQs

How a lot does it value to develop a cellular banking app?

Crafting a cellular banking answer’s value varies based mostly on complexity, options, & safety calls for. A primary paid software program might attain between $20,000-$50,000 worth, with progressive alternates ranging from $100,000.

How lengthy does it take to develop a cellular banking app?

Usually, there are preliminary 90-180 days to craft a completely operational cellular banking platform, relying on the tech package, safety actions, & integrations utilized.

What are the safety measures wanted for a cellular banking app?

Central safety actions embody multi-factor MFA, encoding delicate person data, safeguarded fee gateways, fraud discovery techniques, & watching the area’s tips like GDPR.

Can I combine cellular funds into my banking app?

Sure, integrating cellular fee choices like bank card funds, smartphone wallets, & P2P transfers is usually utilized for e-banking apps to intensify customers’ engagement.