Authorities in at the very least two U.S. states final week independently introduced arrests of Chinese language nationals accused of perpetrating a novel type of tap-to-pay fraud utilizing cellular units. Particulars launched by authorities to this point point out the cellular wallets being utilized by the scammers have been created via on-line phishing scams, and that the accused have been counting on a customized Android app to relay tap-to-pay transactions from cellular units situated in China.

Picture: WLVT-8.

Authorities in Knoxville, Tennessee final week mentioned they arrested 11 Chinese language nationals accused of shopping for tens of hundreds of {dollars} value of reward playing cards at native retailers with cellular wallets created via on-line phishing scams. The Knox County Sheriff’s workplace mentioned the arrests are thought of the primary within the nation for a brand new sort of tap-to-pay fraud.

Responding to questions on what makes this scheme so outstanding, Knox County mentioned that whereas it seems the fraudsters are merely shopping for reward playing cards, the truth is they’re utilizing a number of transactions to buy numerous reward playing cards and are plying their rip-off from state to state.

“These offenders have been touring nationwide, utilizing stolen bank card info to buy reward playing cards and launder funds,” Knox County Chief Deputy Bernie Lyon wrote. “Throughout Monday’s operation, we recovered reward playing cards valued at over $23,000, all purchased with unsuspecting victims’ info.”

Requested for specifics in regards to the cellular units seized from the suspects, Lyon mentioned “tap-to-pay fraud entails a bunch using Android telephones to conduct Apple Pay transactions using stolen or compromised credit score/debit card info,” [emphasis added].

Lyon declined to supply further specifics in regards to the mechanics of the rip-off, citing an ongoing investigation.

Ford Merrill works in safety analysis at SecAlliance, a CSIS Safety Group firm. Merrill mentioned there aren’t many legitimate use circumstances for Android telephones to transmit Apple Pay transactions. That’s, he mentioned, except they’re operating a customized Android app that KrebsOnSecurity wrote about final month as part of a deep dive into the sprawling operations of China-based phishing cartels which might be respiration new life into the cost card fraud trade (a.ok.a. “carding”).

How are these China-based phishing teams acquiring stolen cost card knowledge after which loading it onto Google and Apple telephones? All of it begins with phishing.

In the event you personal a cell phone, the possibilities are wonderful that in some unspecified time in the future previously two years it has obtained at the very least one phishing message that spoofs the U.S. Postal Service to supposedly accumulate some excellent supply price, or an SMS that pretends to be a neighborhood toll street operator warning of a delinquent toll price.

These messages are being despatched via refined phishing kits bought by a number of cybercriminals primarily based in mainland China. And they aren’t conventional SMS phishing or “smishing” messages, as they bypass the cellular networks fully. Moderately, the missives are despatched via the Apple iMessage service and thru RCS, the functionally equal know-how on Google telephones.

Individuals who enter their cost card knowledge at one in all these websites will probably be informed their monetary establishment must confirm the small transaction by sending a one-time passcode to the shopper’s cellular system. In actuality, that code will probably be despatched by the sufferer’s monetary establishment in response to a request by the fraudsters to hyperlink the phished card knowledge to a cellular pockets.

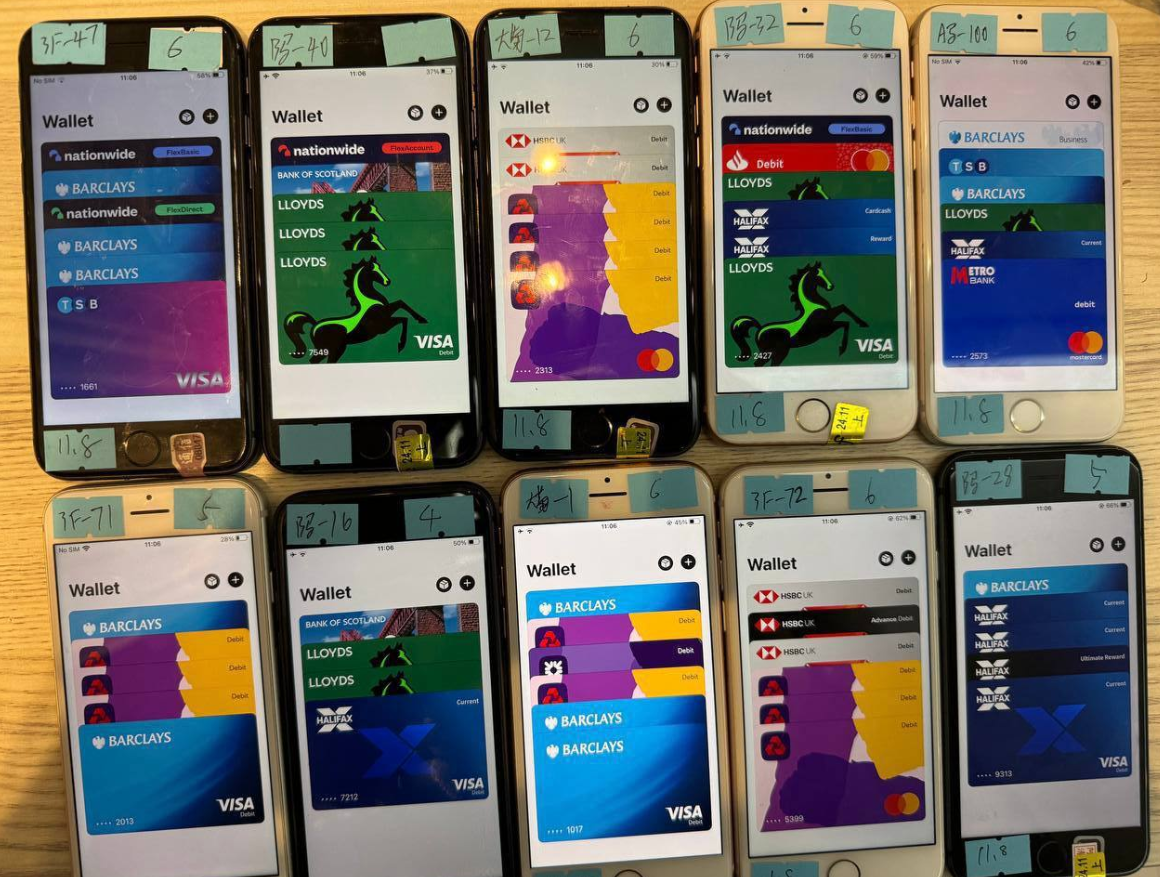

If the sufferer then supplies that one-time code, the phishers will hyperlink the cardboard knowledge to a brand new cellular pockets from Apple or Google, loading the pockets onto a cell phone that the scammers management. These telephones are then loaded with a number of stolen wallets (typically between 5-10 per system) and bought in bulk to scammers on Telegram.

A picture from the Telegram channel for a preferred Chinese language smishing equipment vendor exhibits 10 cellphones on the market, every loaded with 5-7 digital wallets from totally different monetary establishments.

Merrill discovered that at the very least one of many Chinese language phishing teams sells an Android app referred to as “Z-NFC” that may relay a legitimate NFC transaction to wherever on the earth. The person merely waves their telephone at a neighborhood cost terminal that accepts Apple or Google pay, and the app relays an NFC transaction over the Web from a telephone in China.

“I might be shocked if this wasn’t the NFC relay app,” Merrill mentioned, regarding the arrested suspects in Tennessee.

Merrill mentioned the Z-NFC software program can work from wherever on the earth, and that one phishing gang gives the software program for $500 a month.

“It might probably relay each NFC enabled tap-to-pay in addition to any digital pockets,” Merrill mentioned. “They even have 24-hour assist.”

On March 16, the ABC affiliate in Sacramento (ABC10), Calif. aired a section about two Chinese language nationals who have been arrested after utilizing an app to run stolen bank cards at a neighborhood Goal retailer. The information story quoted investigators saying the lads have been attempting to purchase reward playing cards utilizing a cellular app that cycled via greater than 80 stolen cost playing cards.

ABC10 reported that whereas most of these transactions have been declined, the suspects nonetheless made off with $1,400 value of reward playing cards. After their arrests, each males reportedly admitted that they have been being paid $250 a day to conduct the fraudulent transactions.

Merrill mentioned it’s common for fraud teams to promote this type of work on social media networks, together with TikTok.

A CBS Information story on the Sacramento arrests mentioned one of many suspects tried to make use of 42 separate financial institution playing cards, however that 32 have been declined. Even so, the person nonetheless was reportedly capable of spend $855 within the transactions.

Likewise, the suspect’s alleged confederate tried 48 transactions on separate playing cards, discovering success 11 instances and spending $633, CBS reported.

“It’s fascinating that so most of the playing cards have been declined,” Merrill mentioned. “One motive this could be is that banks are getting higher at detecting such a fraud. The opposite might be that the playing cards have been already used and they also have been already flagged for fraud even earlier than these guys had an opportunity to make use of them. So there might be some factor of simply sending these guys out to shops to see if it really works, and if not they’re on their very own.”

Merrill’s investigation into the Telegram gross sales channels for these China-based phishing gangs exhibits their phishing websites are actively manned by fraudsters who sit in entrance of big racks of Apple and Google telephones which might be used to ship the spam and reply to replies in actual time.

In different phrases, the phishing web sites are powered by actual human operators so long as new messages are being despatched. Merrill mentioned the criminals seem to ship only some dozen messages at a time, seemingly as a result of finishing the rip-off takes handbook work by the human operators in China. In any case, most one-time codes used for cellular pockets provisioning are usually solely good for a couple of minutes earlier than they expire.

For extra on how these China-based cellular phishing teams function, take a look at How Phished Information Turns Into Apple and Google Wallets.

The ashtray says: You’ve been phishing all evening.