Introduction

Information is energy. However in retail banking, it’s about turning that energy into actionable insights whereas rigorously navigating knowledge safety dangers. Monetary establishments should strike a stability between defending delicate knowledge and embracing knowledge democratization to enhance buyer experiences, cut back danger, and drive innovation. Sigma Computing, a next-generation analytics and enterprise intelligence platform, supplies a safe path, enabling banks to leverage insights from buyer segmentation to danger evaluation, all with out compromising safety. Let’s dive into how Databricks and Sigma Computing collectively assist these essential use instances, empowering banks to make smarter, safer selections.

Information Intelligence is a New Lifeline for Banking

Digital banks like Nubank and fintechs like Sensible and Brex have outpaced conventional enterprise banking by providing prospects streamlined digital experiences, real-time monetary companies, and clear pricing. In distinction, standard banks typically lag behind as a result of legacy infrastructure. This technical debt results in longer growth cycles and, in consequence, limits banks’ potential to develop new merchandise and anticipate evolving buyer expectations. Greater than ever, knowledge is a strategic asset, and banks can leverage knowledge as a aggressive benefit.

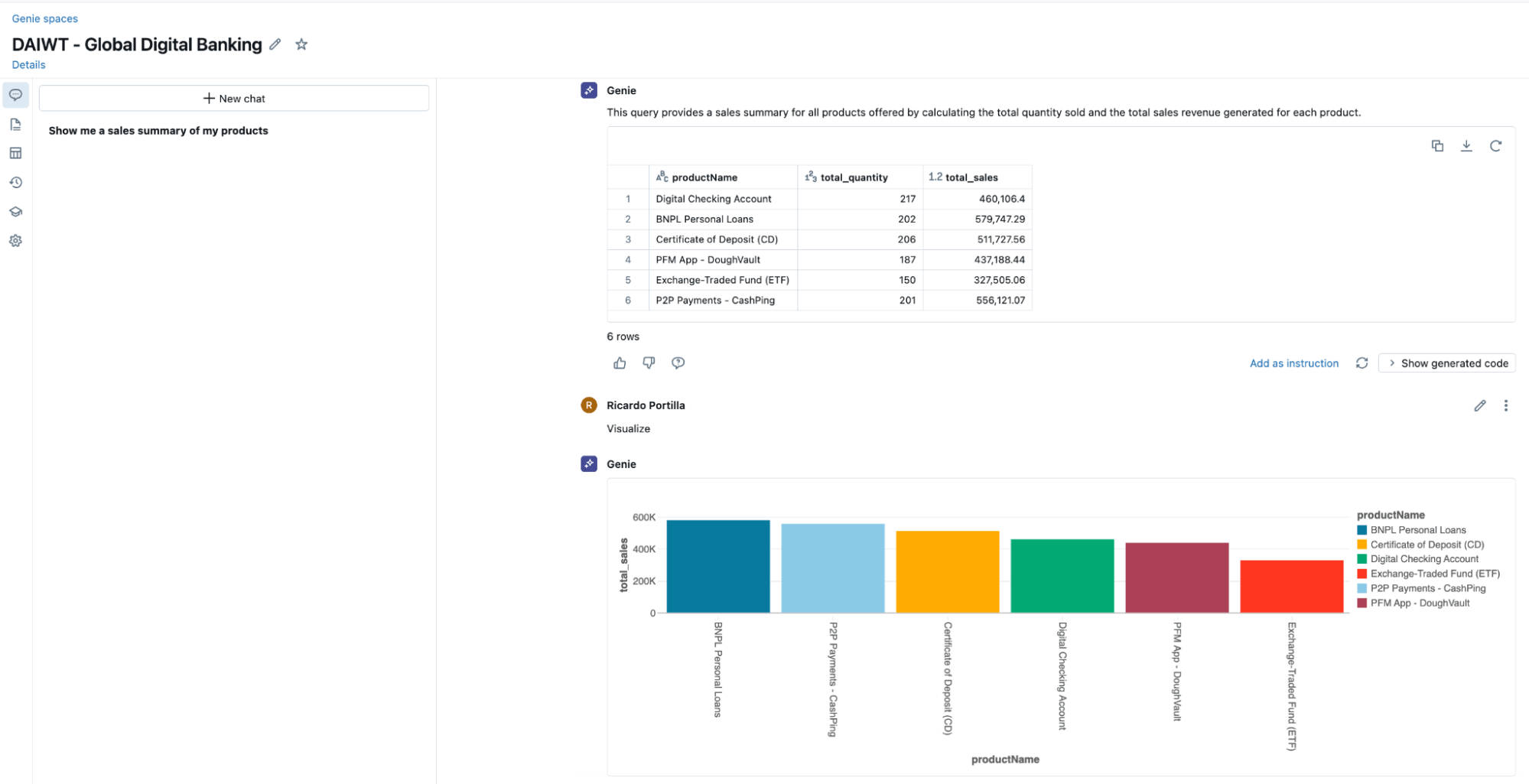

Information intelligence is a key to unlocking the total potential of enterprise knowledge. To align with our imaginative and prescient of full knowledge democratization to any consumer, Databricks releases instruments similar to Genie areas, a conversational interface the place enterprise customers can interrogate their knowledge. What differentiates Genie is that this service incorporates full enterprise context of enterprise jargon and technical metadata, constructed into the area as a basis for answering enterprise questions through Unity Catalog, Databricks’ governance resolution.

Why Banks Battle with Attaining Information Democratization

Banks are extremely regulated and risk-averse by nature. They deal with huge volumes of delicate knowledge, from transaction histories to non-public buyer data, which makes them prime targets for cyberattacks and insider threats. Information exfiltration—the unauthorized switch or theft of knowledge—looms as a continuing danger, driving stringent safety protocols. However right here’s the dilemma: whereas defending knowledge is important, locking it down too tightly hampers innovation and slows decision-making.

On this area, knowledge democratization turns into a problem. Democratization guarantees to unlock the potential of knowledge, placing it within the arms of those that can act on insights—knowledge analysts, product managers, and even executives. Nevertheless, banks typically discover themselves torn between their want for open, versatile entry to knowledge and the strict safety measures they have to uphold.

Conventional knowledge programs in banks are siloed, making it tough for groups to share knowledge seamlessly throughout departments. The worry of unauthorized entry results in a restrictive surroundings the place solely a choose few have the privilege to entry essential data. This bottleneck stifles the agility that knowledge democratization goals to offer. Moreover, regulatory compliance provides one other layer of complexity, as banks should be certain that they meet native and world requirements like GDPR and CCPA whereas nonetheless fostering a data-driven tradition. A primary instance of a financial institution that solved these issues is HSBC, with their reinvention of funds, powered by Databricks. They have been in a position to consolidate 14 databases right into a single Lakehouse. Furthermore, they have been in a position to defend knowledge by masking in real-time and modernized their buyer segmentation technique, ensuing within the #1 funds app in Hong Kong.

Within the subsequent part, we’ll discover how prospects can use Databricks and Sigma Computing to resolve the challenges above.

Unleashing Information Intelligence Whereas Adhering to Compliance

The Enterprise Downside

Think about a set of enterprise analysts tasked with rising loyalty for banking merchandise in revolving credit score. The interior IT group should present these analysts with no-code, non-technical tooling. There are stringent necessities for limiting export performance. However, analysts want to control knowledge with full entry to lineage and metadata to clarify any enterprise end result, similar to a proactive credit score line improve provide, to their stakeholders.

Market Instruments for Self-service Evaluation

Finish customers require self-service evaluation. Typically, the first supply device to allow that is Excel. Nevertheless, offering knowledge in Excel is a surefire approach to improve knowledge exfiltration danger and proliferate copies of knowledge, resulting in inefficiencies. Enter Sigma computing.

Sigma affords a path for finish customers to view knowledge feeds and analytics with out offering unbridled entry to datasets. Sigma additionally brings familiarity with spreadsheet UX, which makes adoption amongst Excel customers particularly frictionless. Sigma affords platform groups a singular approach to lengthen knowledge to non-technical customers utilizing a assemble often called ‘safe embeds’.

Permitting True Self-service with Sigma’s Safe Embed

Sigma lets you create a safe embed self-service widget within the utility of your alternative. For instance, builders can create a Flask app, embedded e-mail, or Groups integrations that authenticate with JWT tokens and name the Sigma service. JWT (JSON Net Tokens) are compact, URL-safe tokens that securely transmit data between programs, making certain knowledge integrity and authentication. This format is foundational for contemporary, API-driven functions, permitting giant enterprises to authenticate customers securely with out exposing delicate data. On this Sigma Computing and Databricks integration, JWT ensures customers are granted real-time, customized entry to workbooks and dashboards. JWT permits for safe consumer entry to monetary knowledge, and this implementation protects dashboard entry, sustaining each efficiency and safety by embedding user-specific claims inside every token.

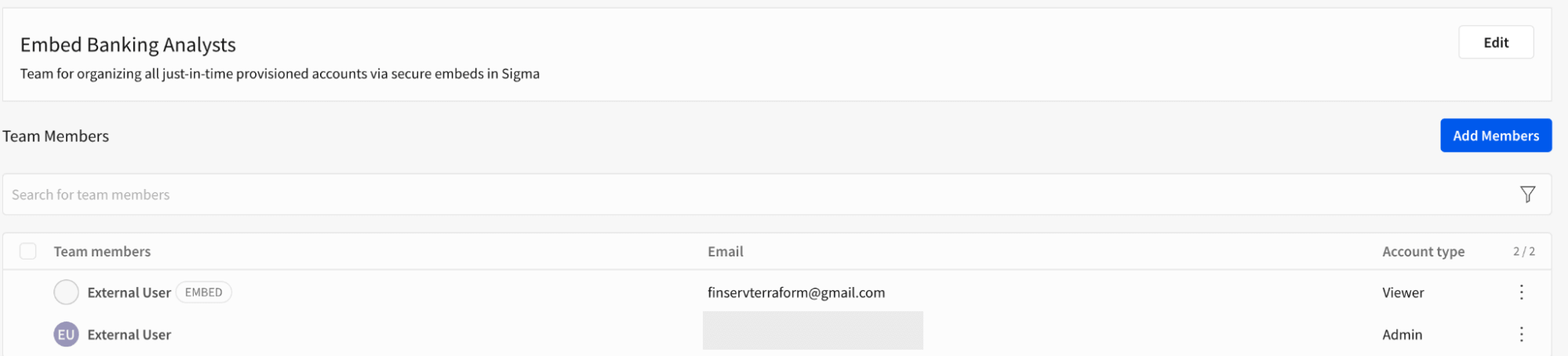

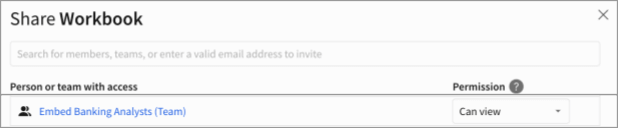

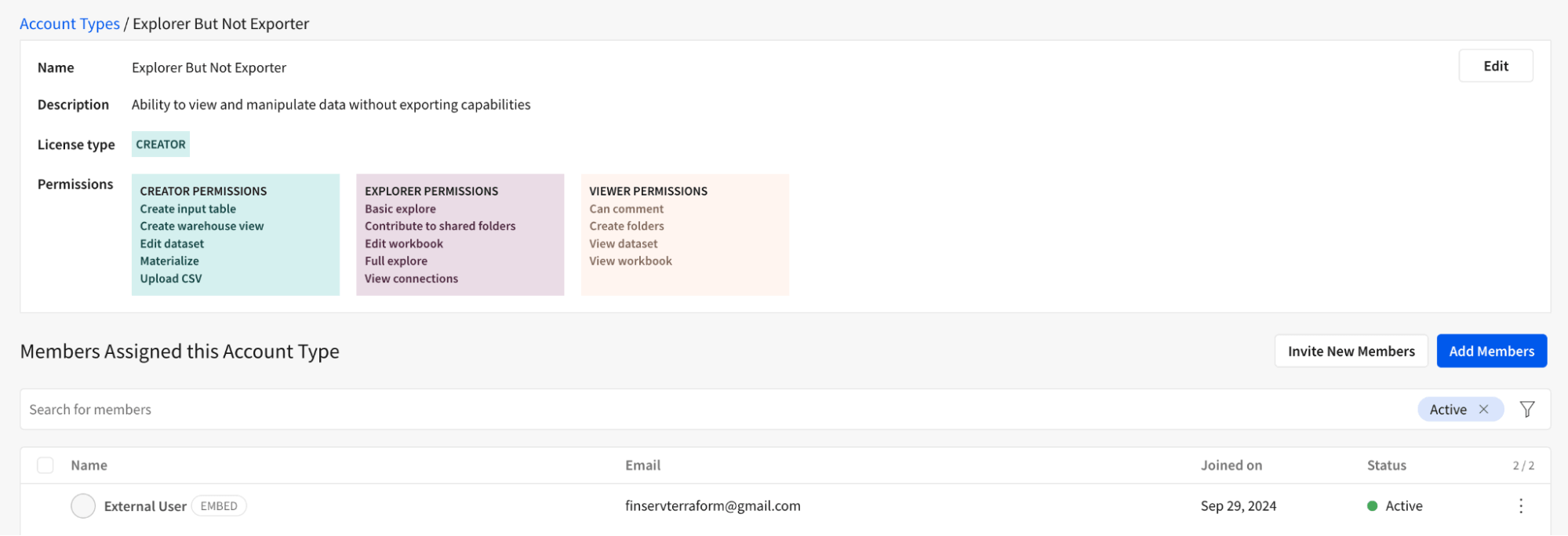

Embed Customers with No Workspace Entitlements

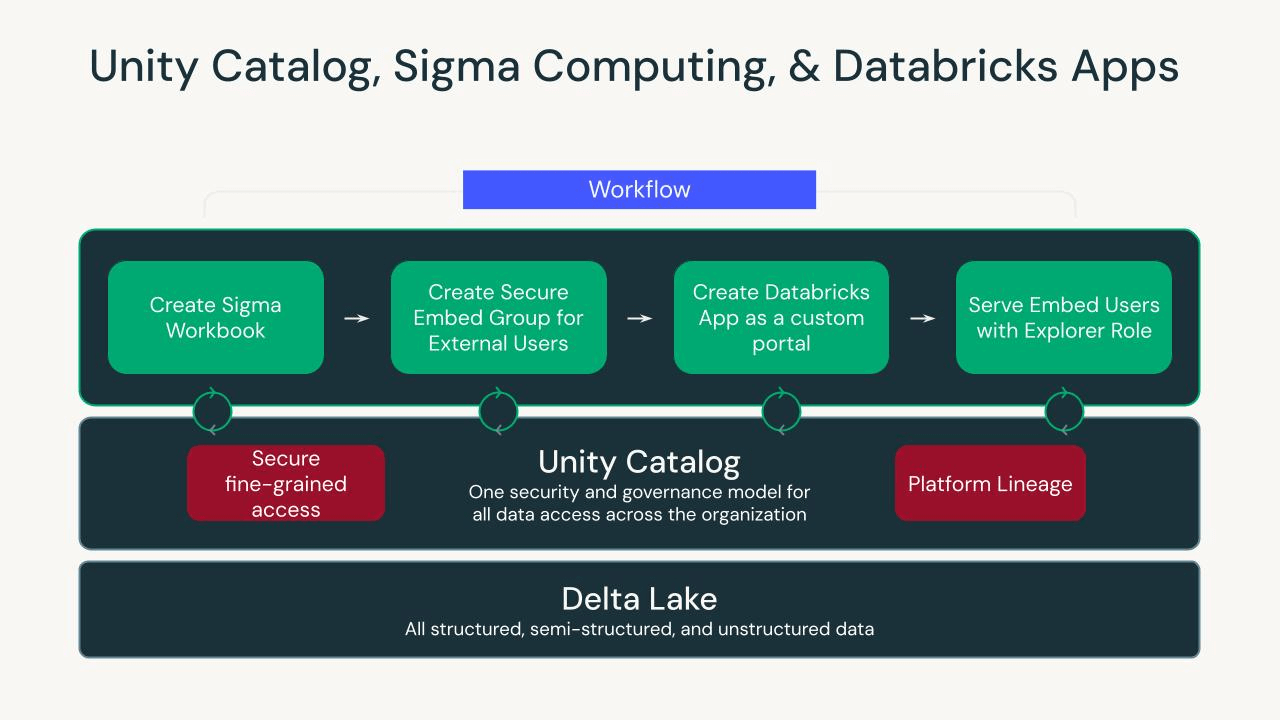

Customers can now simply entry knowledge, and role-based entry controls could be utilized to allow workbook homeowners to offer restricted entry in a easy one-time toggle. See the pictures beneath for reference. Right here, the exterior consumer resides within the ‘Embed Banking Analysts’ group. The analytics workbook homeowners present one-time entry to the embed consumer group, and finish customers are able to devour any dataset they’re entitled to. All of the fine-grained entry controls outlined as a part of Unity Catalog lengthen to teams in Databricks, notably row and column-level filtering.

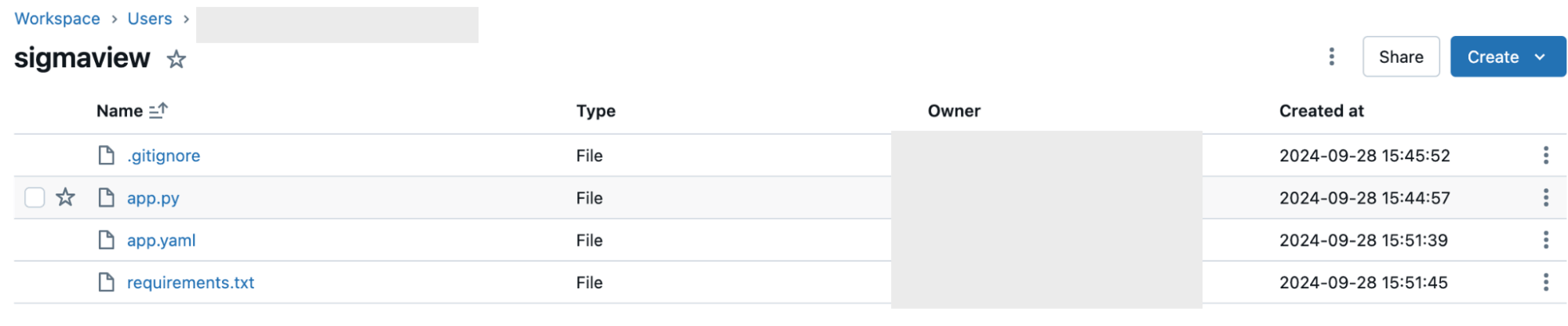

Deploying Monetary Analytics Apps on the Area-Intelligence Lakehouse

Databricks now affords a model new, streamlined approach to deploy the applying to serve safe embed customers – Databricks Apps. Utilizing Databricks Apps, knowledge engineering groups can develop and sync code into the Databricks workspace and deploy an utility inside minutes, making knowledge accessible to analysts and non-technical customers simply as they might in an ordinary customized portal. Whether or not you’re utilizing Databricks Apps or a self-hosted utility (we use Flask in our Apps demo), platform groups can onboard embed customers to totally democratize knowledge to non-technical customers who’re used to leveraging pivot tables and on-the-fly ratios for banking use instances.

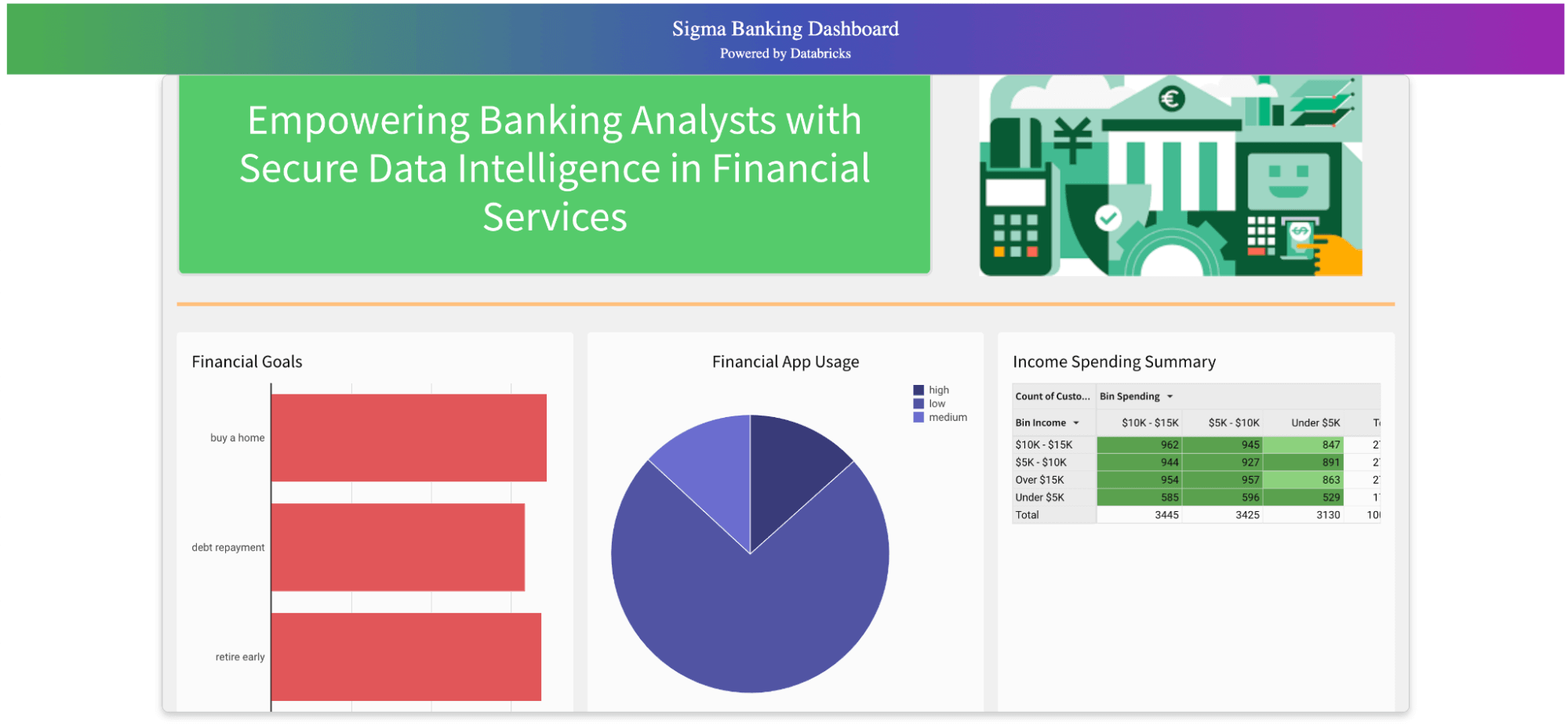

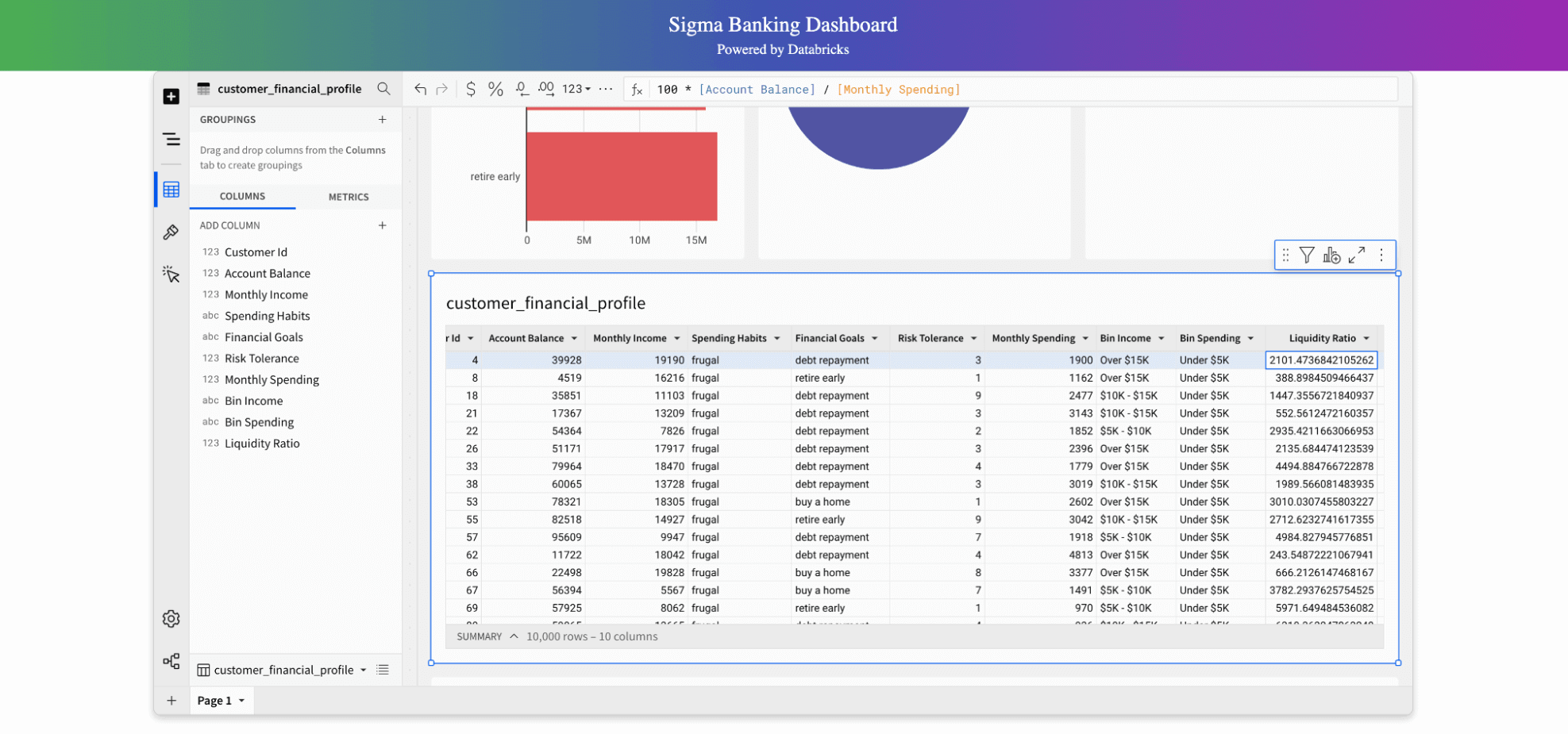

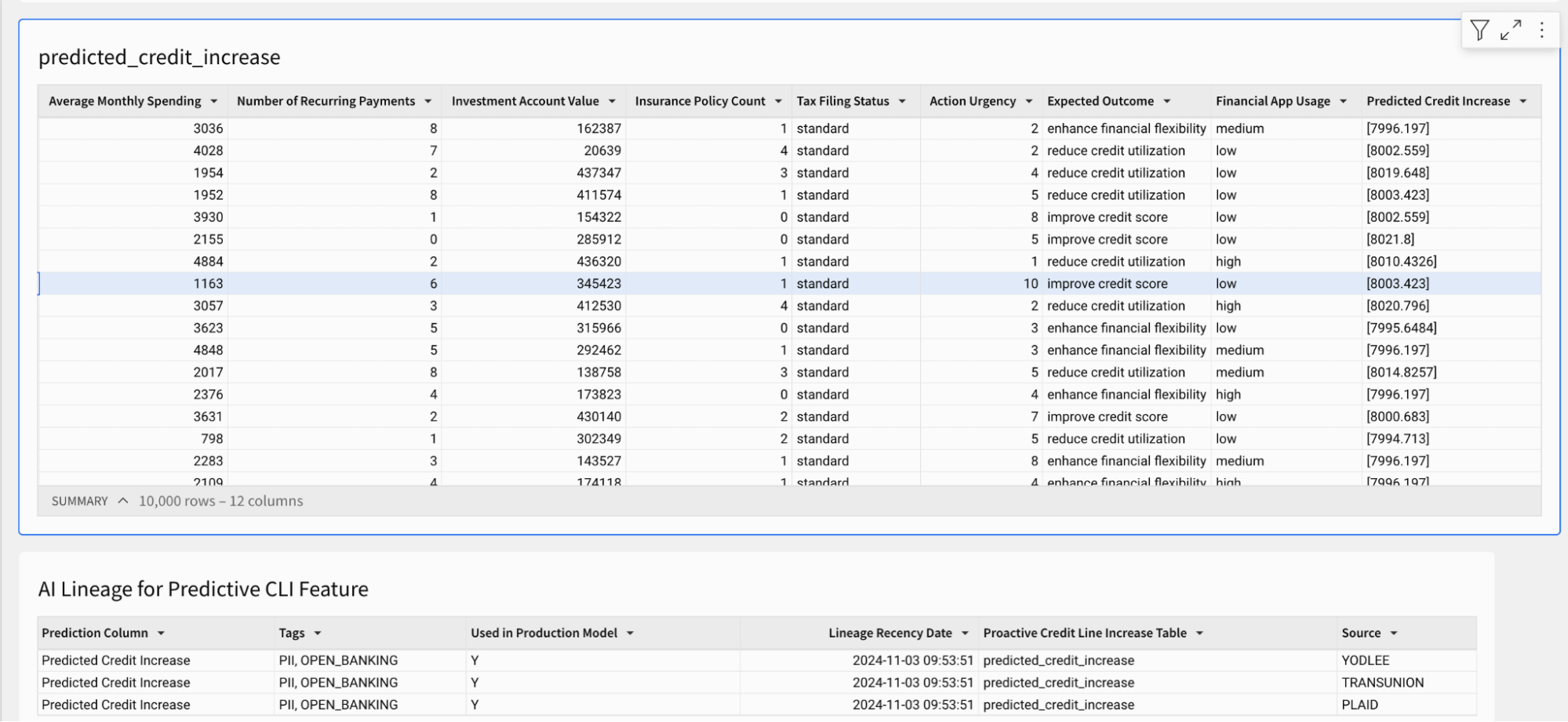

In our pattern app, we deal with prospects with inside profiles and exterior knowledge from a credit score bureau (e.g., TransUnion) and monetary aggregators similar to Plaid and Yodlee, which is able to provide credit score scores, credit score strains, and developments on utilization of economic merchandise. Our preliminary abstract (beneath in purple) reveals that almost all prospects are excited about residence possession. However, engagement is low, and the financial institution we work for is excited about rising loyalty. As a place to begin, our embed customers can rapidly have a look at liquidity ratios and goal buyer segments for a proactive credit score line improve.

The analytics we see are useful, however how can we empower embed customers with a greater exploration expertise with out sacrificing knowledge exfiltration danger?

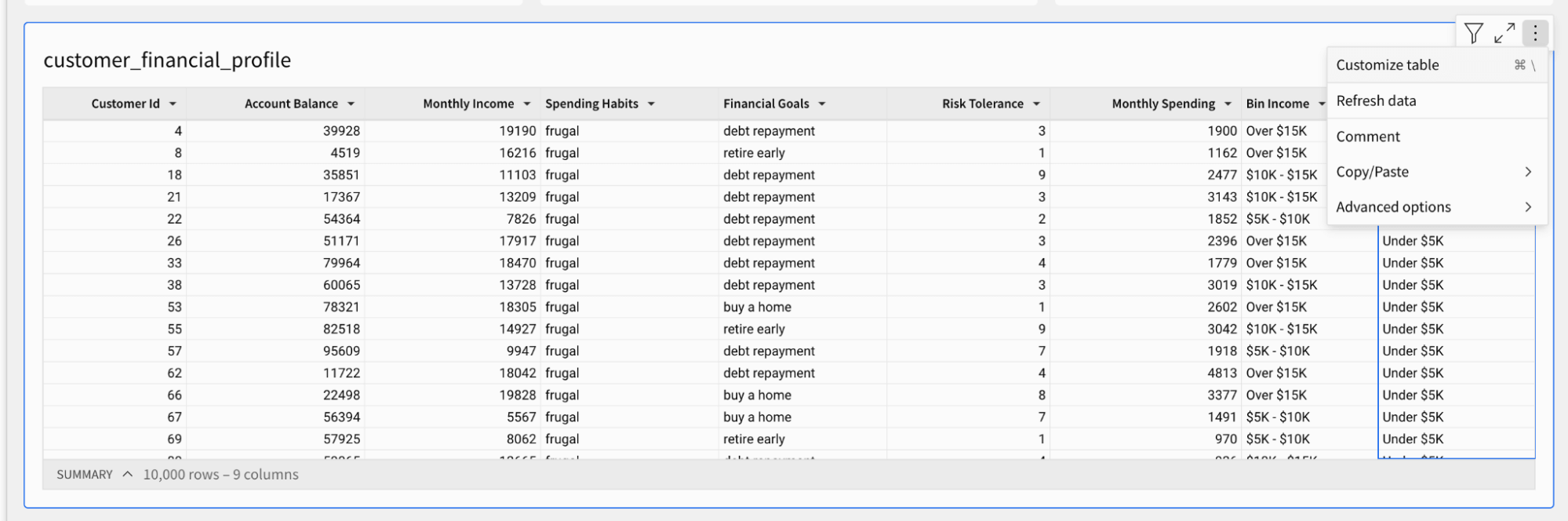

As seen beneath, contained in the Sigma surroundings, we are able to create a completely custom-made function referred to as ‘Explorer However Not Exporter’, stopping customers from exporting knowledge utilizing obtain buttons. Within the spirit of innovation, we give the analyst consumer rights to edit the workbook, for instance, new column calculations and creations, which is able to enable for a a lot richer expertise and including calculations similar to liquidity ratios for effectively assessing alternatives for proactive credit score line will increase or investments for banking purchasers. Customers at the moment are totally empowered so as to add analytics customized to their questions.

Whereas the expertise has allowed customers to create new binning, heatmaps, and segmentation lists, how will we guarantee belief within the knowledge produced? Our pattern tables within the utility present a proactive credit score line improve prediction, which we are able to now apply to our goal segments. Analysts should perceive the place predictions originate to clarify analytics and outcomes to enterprise stakeholders and executives. With the built-in lineage in Unity Catalog, which extends past knowledge into fashions, dashboards, options, and capabilities, we are able to pinpoint precisely the place our predictions got here from. The entire derived supply data beneath and tags are simply obtained from Unity Catalog system tables (AWS | Azure | GCP), offering a better degree of belief and explainability with the enterprise.

Conclusion

The monetary companies business is at a crossroads. Conventional banks can not afford to stay certain by outdated, siloed knowledge programs, whereas fintech disruptors proceed to redefine buyer experiences by way of real-time knowledge intelligence. On this high-stakes surroundings, safe knowledge democratization is not only a luxurious—it is a lifeline.

Sigma Computing’s safe embed capabilities, mixed with Databricks’ sturdy utility deployment platform and knowledge lakehouse, current a transformative resolution for banks in search of to leverage knowledge with out compromising safety. Sigma’s safe embeds present a managed expertise that aligns completely with stringent regulatory necessities. With Sigma, banks can empower their analysts, investigators, product managers, and gross sales groups to entry very important insights in a safer and compliant surroundings.

By deploying functions on Databricks, monetary establishments can swiftly and seamlessly lengthen safe knowledge entry to embed customers, customizing experiences whereas sustaining an ironclad grip on knowledge safety. In an business the place the margin for error is razor-thin, the power to ship data-driven insights by way of safe, embedded functions turns into a aggressive edge.

The message to monetary establishments is obvious: the time for passive knowledge methods is over. Those that embrace safe, self-service knowledge intelligence will mitigate dangers and unlock the agility wanted to thrive in immediately’s digital market. Banks should evolve now, and leveraging instruments like Sigma Computing and Databricks can activate a data-driven tradition that turns uncooked data into actionable insights.

Join Databricks and Sigma immediately to allow safe, self-service knowledge intelligence.