Whereas the fourth quarter was good for Apple, analysts solely care in regards to the vacation quarter’s large income. A interval that will likely be closely influenced by the rollout of Apple Intelligence.

On Halloween night time, Apple provided a deal with to buyers within the type of its monetary outcomes. Its fourth-quarter figures for 2024 hit lots of good notes for the corporate.

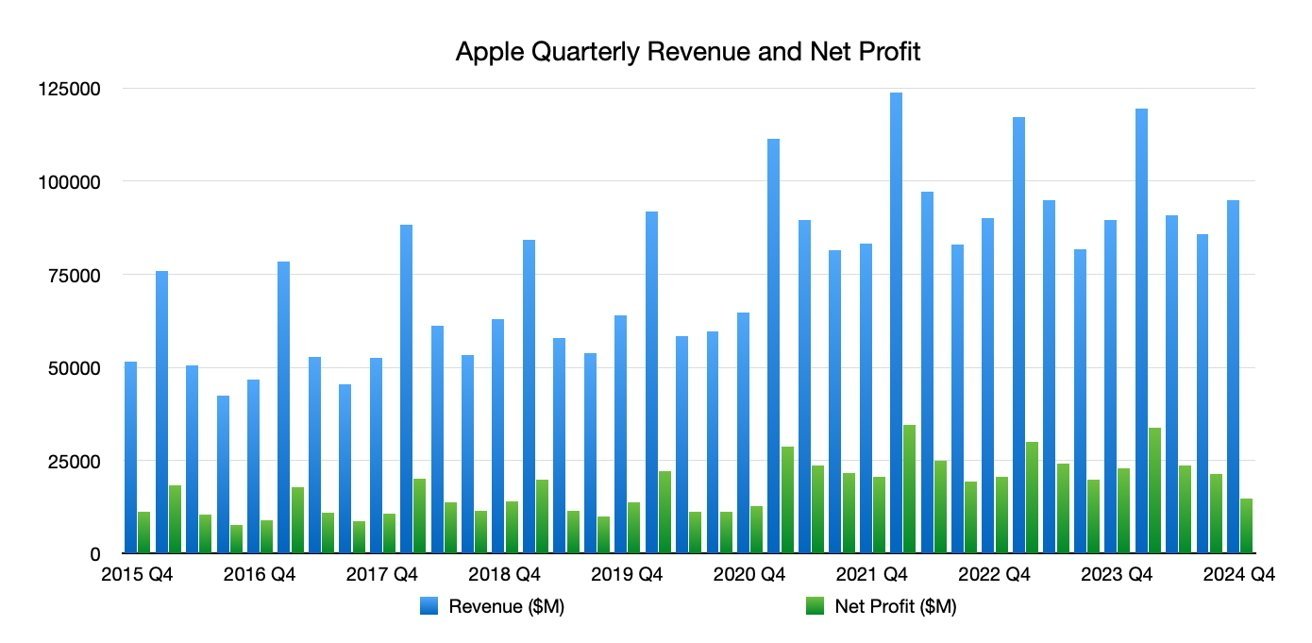

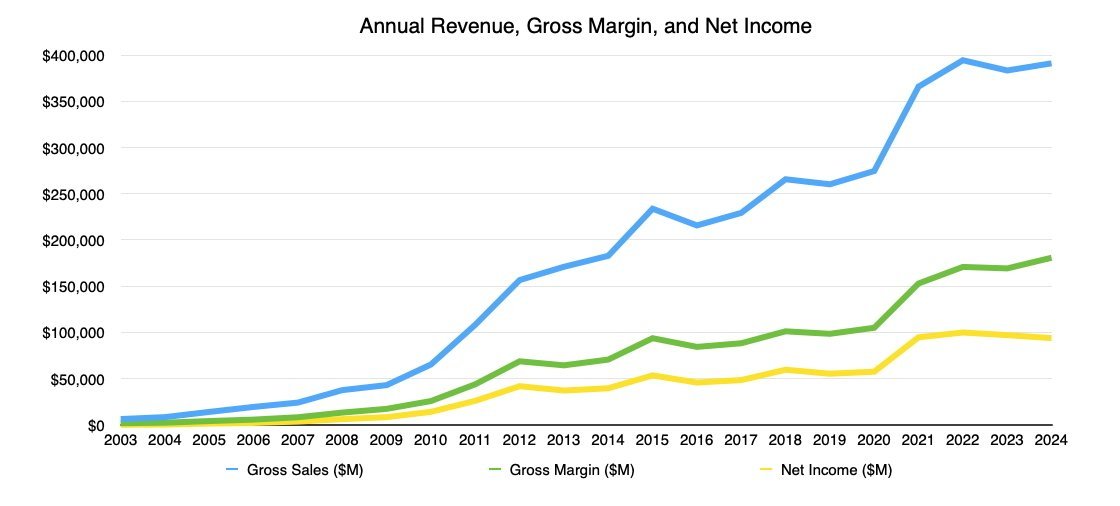

For a begin, the $94.93 billion in income it reported for the interval is a 6.1% year-on-year improve. In actual fact, it is greater than the $91.8 billion Apple reported in its Q1 2020 outcomes.

That is spectacular as a result of the primary quarter of the 12 months is all the time Apple’s highest-selling. Vacation buying habits, together with the autumn releases of latest merchandise, make Q1 a really profitable interval.

Likewise, the gross margin of $39.7 billion is up 8.5% year-on-year, as is the working revenue of $29.6 billion, up 9.7%.

The online revenue of $14.7 billion is a giant dip of 35.8% in comparison with This autumn 2023. Nevertheless, the web revenue regularly swings between a rise and a lower over time anyway.

The primary factor is that it is nonetheless a internet revenue, not a loss.

Product earnings

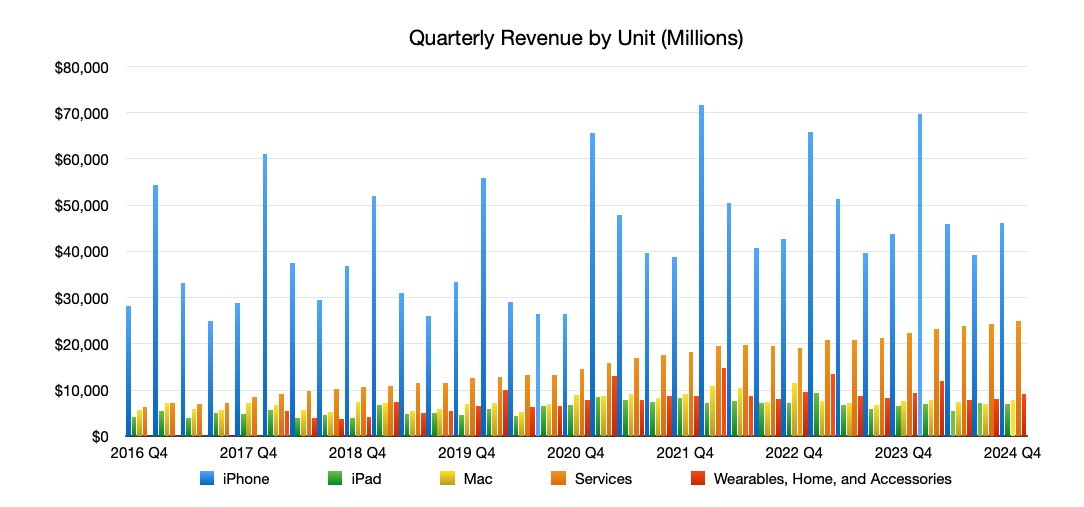

Apple’s key product, the iPhone, noticed a rise in gross sales through the quarter. At $43.8 billion, it is up 5.5% year-on-year, which is an effective begin for the iPhone 16 technology.

The important thing right here is that the iPhone 16 vary will not actually have made a lot of an influence on the quarter in any respect. It was launched so late that it might have had two weeks to maneuver the needle.

That is additionally true for different merchandise Apple launched in its fall occasions, just like the AirPods Max with USB-C and the Apple Watch Collection 10. Positive, Apple loved gross sales, however not sufficient to be obsessed with at the moment.

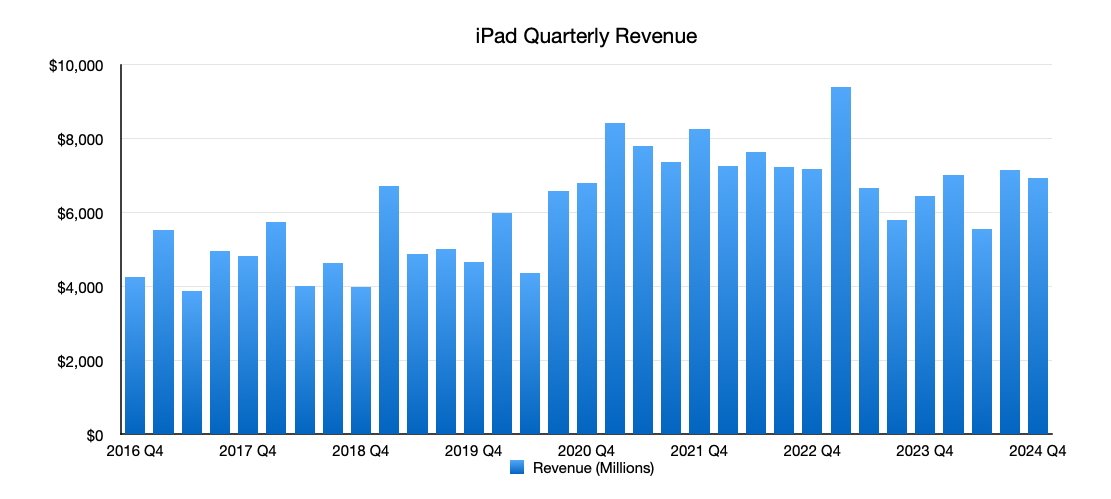

It should, nevertheless, see greater adjustments from merchandise it introduced out within the third quarter. This gorgeous a lot consisted of an iPad love-in, with the M4 iPad Professional, M2 iPad Air, and the Apple Pencil Professional getting a full quarter of gross sales.

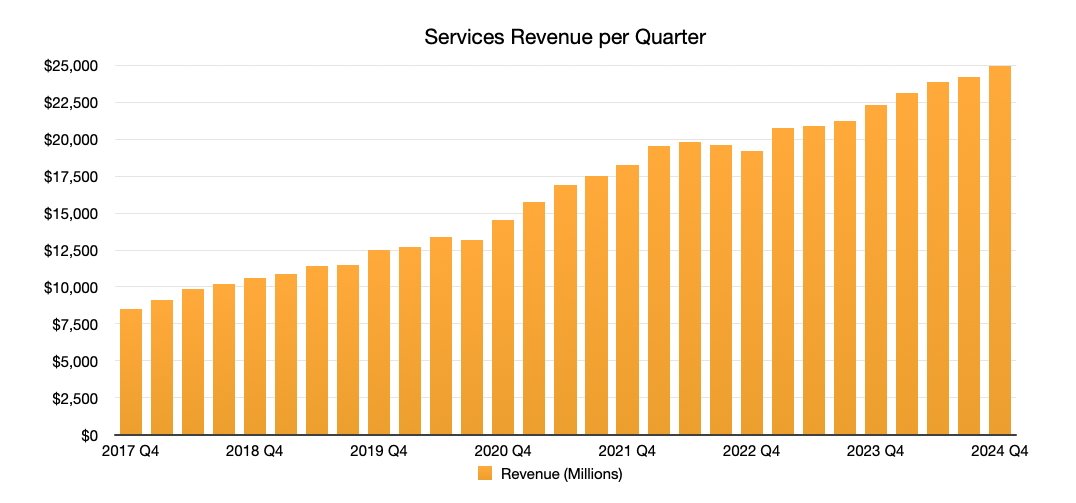

Because of this, iPad gross sales reached $6.95 billion, up year-on-year by 7.9%. Companies, Apple’s consistently-growing section, went up by 11.9% year-on-year to $24.7 billion.

Though there have been no Mac launches on Q3 nor This autumn, there was nonetheless a really small rise of 1.7% to $7.74 billion.

Q1 2025 with a contact of Apple Intelligence

Whereas Apple’s This autumn product launches are essential, they will not actually matter till the primary quarter of 2025. That is the three-month interval when Apple makes essentially the most of its cash, and it occasions its product launches to match.

Not solely will Apple profit from the standard gross sales patterns right now of 12 months for the iPhone 16, but it surely also needs to take pleasure in extra gross sales from the gradual rollout of Apple Intelligence by the interval and past.

Apple Intelligence will even assist in two different product classes which had launches in October, the beginning of the quarter. The iPad mini‘s improve to make use of Apple Intelligence provides one other pill to the vary utilizing the generative AI options, and at a extra consumer-friendly value than the iPad Professional.

Then there are the Mac launches from Apple’s October week of bulletins. The updates to the 24-inch iMac and MacBook Professional traces with M4 chips, together with the overhauled Mac mini, additionally provide extra improve paths bumped up with the promise of Apple Intelligence.

As normal, Apple declined to offer precise steering for Q1 2025 outcomes. Commentary signifies that progress could possibly be low for the interval, to single digits year-on-year.

Even so, it’s going to intention to beat its earlier highs. For Q1 2023, it reported $119.58 billion in income, whereas its file is Q1 2022 with $123.95 billion.

Analyst opinion

Earlier than Apple’s outcomes have been launched, analysts provided forecasts on what to anticipate from the outcomes. After the discharge, the identical analysts present their reactions to the outcomes, typically justifying or glossing over their forecast versus actuality.

Morgan Stanley has combined emotions, with the outcomes providing one thing for bulls and for bears, “leaving the controversy little modified.” The Q1 outlook is “combined” with lighter income than its shopping for expectations, however with a greater gross margin than the consensus view.

For iPhone, the Q1 outcomes might count on flat revenues. Bulls will pull for a doable supercycle within the iPhone 17, whereas bears will say the inventory is pricey, the observe to buyers provides.

Morgan Stanley charges Apple as “Obese” with a value goal of $273.

In Evercore’s observe, Apple introduced a “modest upside” to the This autumn outcomes. The 6% income progress was due to a sturdy iPhone and Companies efficiency, offsetting muted progress elsewhere.

It factors to Apple’s information to single-digit progress within the Q1 2025 outcomes and a extra staggered iPhone cycle in sync with the Apple Intelligence rollout as issues to think about. This might lead to a “extra tempered” seasonality in Q2 and Q3 2025.

Evercore maintains an “Outperform” ranking for Apple, with a $250 value goal.

The Piper Sandler observe to buyers on Friday stated Apple delivered outcomes barely forward of expectations, however with the December quarter set to be beneath consensus forecasts.

This might translate to muted iPhone progress, which is already apparently seen by Apple assembly supply-demand parity with the usual iPhone fashions. “Except Apple Intelligence unexpectedly drives greater demand, we suspect iPhone unit upside over the following few quarters might stay restricted,” the observe reads.

Elsewhere, Mac was in line, iPad beneath expectations, and Companies barely missed consensus expectations.

Piper Sandler reiterates Apple as “Impartial” with a $225 value goal.

In its observe, TD Cowen says the December quarter outlook is “kind of enough to appease buyers who might have been fearing the worst.” September quarter revenues have been in line, with iPhone and flat China revenues “relative positives given the difficult macro.”

iPhone was barely above its consensus, with iPad nonetheless benefiting from the up to date iPad Air and iPad Professional. Mac stands to achieve from the latest launches and the potential for extra generative AI options.

TD Cowen lists Apple as a “purchase” with a $250 value goal.