Apple can be revealing the small print of its fourth-quarter and full-year earnings for 2024 with its monetary outcomes launch and convention name on October 31. This is what to anticipate from Apple, in addition to the expectations of analysts watching the corporate.

Apple’s quarterly earnings report can be launched on Halloween, forward of its investor and analyst convention name at 5 PM Japanese time.

Whereas the decision will function CEO Tim Cook dinner and CFO Luca Maestri discussing the monetary outcomes with a bit extra coloration, it will likely be an uncommon occasion. Maestri is stepping down as CFO on the finish of 2024, making it his final investor name earlier than Kevan Parekh takes the position.

Even after this week of Mac releases, AppleInsider can be listening to the convention name and reporting the monetary ends in full.

Product launches

Whereas the fourth quarter usually offers with the monetary for a 3 month interval till the tip of September, the merchandise that have an effect on it may be launched so much earlier. Releases late within the interval will matter extra for the subsequent monetary yr, when extra time has handed for gross sales.

For instance, the iPhone 16 technology launch on September 20, in addition to USB-C AirPods Max, AirPods, the Apple Watch Sequence 10, and the Apple Watch Extremely 2 in a brand new black colorway black, will not make that a lot of a dent within the funds. Nonetheless, with excessive vacation quarter gross sales on the horizon, they are going to be extra essential within the Q1 2025 outcomes than in This fall 2024.

The Q3 2024 releases may have loved over a complete quarter of gross sales, making them extra impactful. This implies the iPad Professional replace to M4, the iPad Air with M2, and the Apple Pencil Professional.

The quarter was additionally absent any Mac Mac launches. Nonetheless, any upcoming Mac updates will solely have an effect on the Q1 2025 outcomes.

One yr in the past – This fall 2023

The yardstick that the This fall 2024 outcomes can be based mostly on, the This fall 2023 financials will assist give traders an indication of the place Apple is headed.

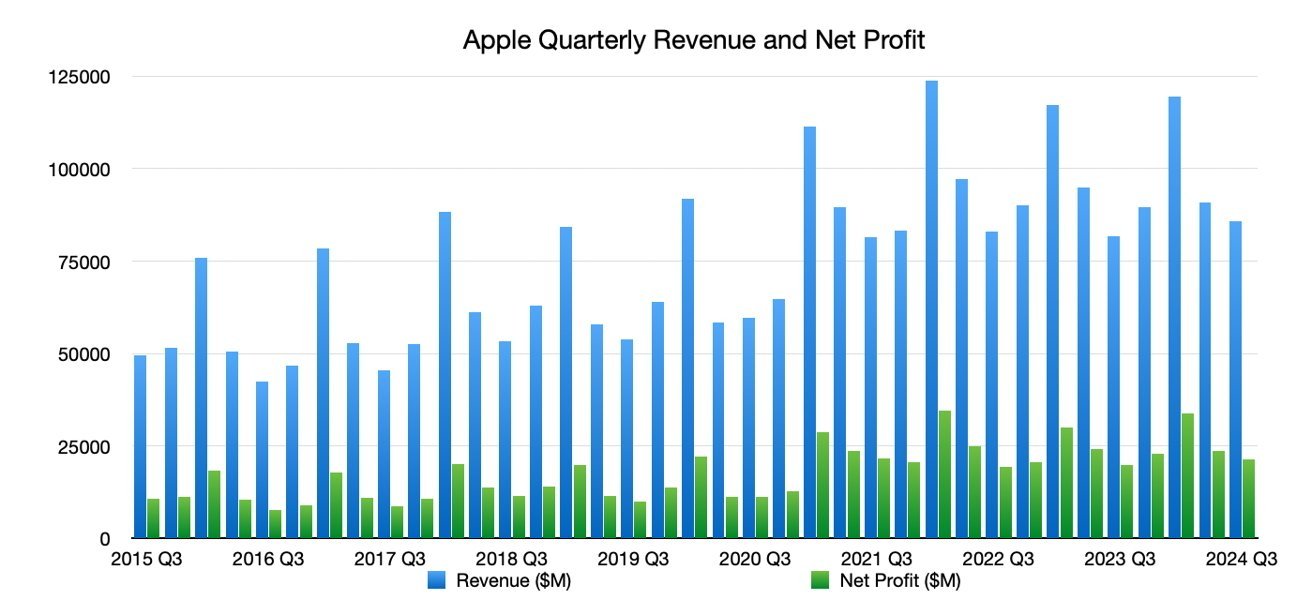

For This fall 2023, Apple reported total income of $89.5 billion, down year-on-year by 0.7%. The earnings per share on the time was set at $1.46.

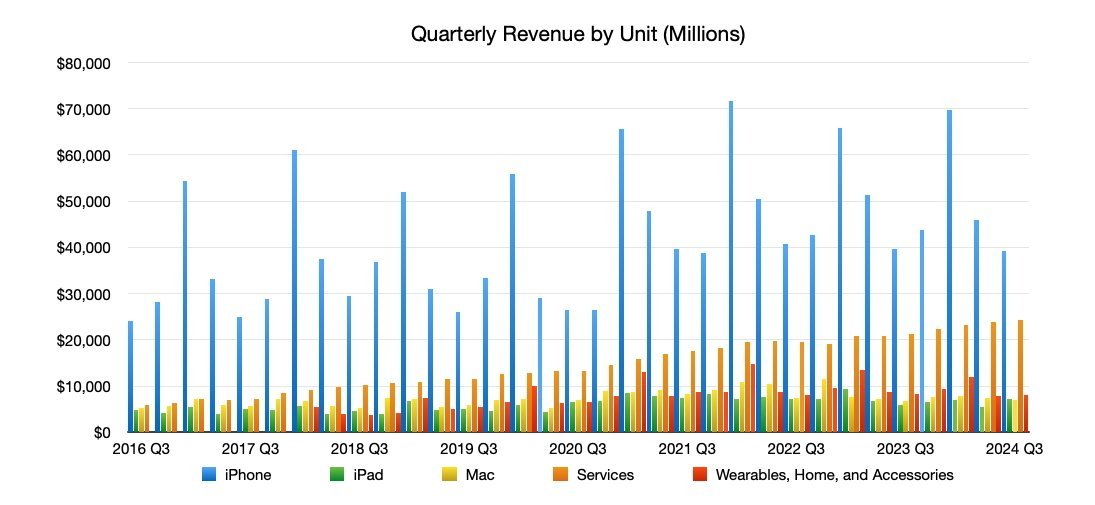

The essential iPhone income went up 2.8% year-on-year to $43.8 billion. Providers additionally noticed continued progress of 16.3% to $22.3 billion.

Against this, iPad’s $6.4 billion income was a drop of 10.2% year-on-year. Mac income went down additional, 33.8% year-on-year to $7.6 billion.

Wearables, Residence, and Equipment dropped too, however at a decrease 3.4% to $9.3 billion.

One quarter in the past – Q3 2024

Whereas not as helpful for comparative goal than This fall 2023, the Q3 2024 outcomes are the place the This fall 2024 outcomes begin off from.

The interval noticed income rise year-on-year to $85.78 billion, with an earnings per share of $1.40.

iPhone income was flat at $39.3 billion, down YoY by 0.9%. Wearables, Residence, and Equipment additionally noticed a drop of two.3% to $8.01 billion.

In the meantime, iPad jumped YoY by 23.7% to $55.6 billion, Mac raised 2.5% to $7.45 billion, and Providers loved 14.1% progress to $23.9 billion.

Full yr – 2023

The outcomes can even embody full-year income for Apple, throughout all 4 quarters. Naturally, this may be in comparison with 2023’s model.

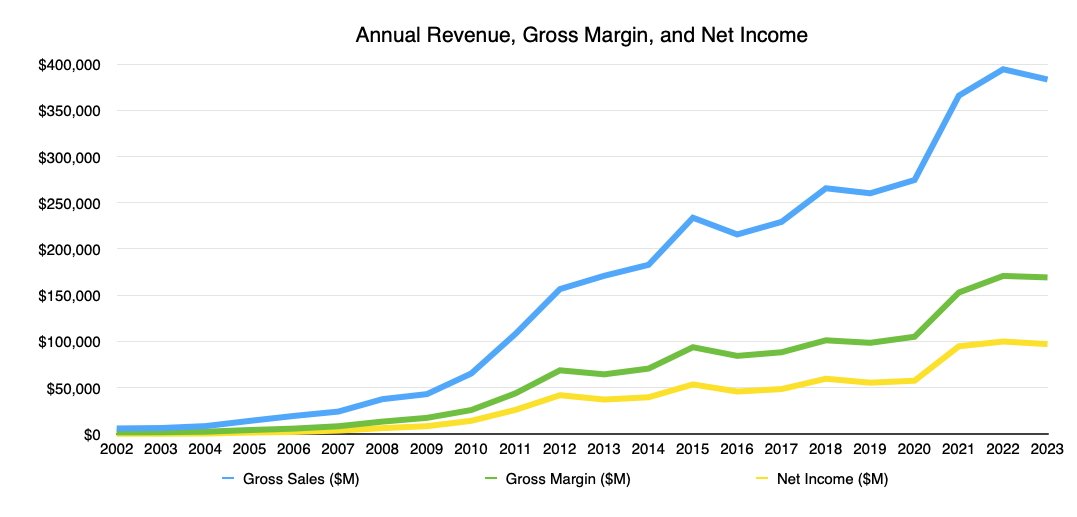

For 2023, the product sales hit $383.3 billion, down 2.8% from 2022’s document. Gross margin reached $169.1 billion, additionally down 1% in opposition to 2022.

For 2024 up to now, Apple’s product sales are at $296.1 billion, with a gross margin of $136.8 billion. To beat the 2023 full-year outcome, Apple has to report not less than $87.2 billion in income for This fall.

Wall Avenue Consensus

The Wall Avenue consensus refers to a survey of analysts. The outcomes are averaged out to provide a normal opinion of the place traders and analysts are leaning of their quarterly forecasts.

Within the estimates revealed by Yahoo Finance as of October 24, 26 analysts provided a median income estimate of $94.4 billion. The estimate’s vary goes from a excessive of $97.74 billion to a low of $93.75 billion.

For the earnings per share, a bunch of 27 forecasts a median of $1.55, with a excessive of $1.65 and a low of $0.92.

On October 23, TipRanks provided its personal consensus figures. Based mostly on 25 analysts, the income averages at 94.3 billion for the quarter, with a excessive of $98 billion and a low of $93 billion.

It provides that 20 out of the 25 analysts boosted income projections over the past three months. On the subject of EPS, 21 out of 26 analysts additionally raised estimates, additionally an indication of optimism.

The consensus for the earnings per share was averaged at $1.59, with a excessive of $1.65 and a low of $1.53.

On October 24, Zacks’ consensus estimate places Apple at having income of $94.43 billion. That is up 5.5% year-on-year.

For the earnings per share, the consensus is $1.54 per share, once more up 5.5% year-on-year. Nonetheless, it provides that the estimate has been revised 0.9% decrease over the course of 30 days.

Analysts

As time shortens earlier than Apple really points its outcomes, analysts at numerous monetary establishments supply their very own forecasts for Apple’s quarter.

On October 22, Morgan Stanley provided a forecast of a 2% income beat for Apple’s upcoming outcomes. For the EPS, Morgan Stanley thinks it will likely be a 4% beat, too.

The agency provided extra focus concerning the December quarter, with the Q1 2025 outcomes prone to be 1% down from consensus for income, and a pair of% down for EPS forecasts. It blames “combined iPhone knowledge factors” that time to extra constrained quarterly iPhone shipments.

Nonetheless, it nonetheless feels that “any inventory underperformance can be shortlived.” Due to this fact it maintains an “Chubby” score and a $273 value goal.

On October 22, Loop Capital reported a revision to its iPhone income forecast, with stronger-than-anticipated iPhone shipments. The availability chain is doing higher than it beforehand forecasted, with indicators of robust demand.

For iPhone income, Loop Capital upgraded its estimate from $48.6 billion to $49.3 billion.

It additionally maintains a purchase score on the shares, with a value goal of $300.

In an October 28 be aware to traders, Piper Sandler proposed that the full-year income for Apple in 2024 can be $390.174 billion. The earnings per share for your complete yr is anticipated to succeed in $6.69.

The analysts referred to earnings calls from main US carriers when discussing the iPhone 16, together with how it’s “down barely over final yr’s ranges on an introduction.” T-Cellular commented that improve charges have been low, because of customers having dearer and extra sturdy units readily available.

Knowledge collected by the agency signifies “the iPhone 16 cycle is not materially totally different from the newest cycles,” and that buyers are holding onto their units for longer. In the meantime, expectations that Apple Intelligence will assist drive first-adopter updates are apparently unfounded.

The October 28 be aware from J.P.Morgan anticipates a “higher than anticipated” quarter, however with weaker than anticipated steerage for the next quarter. Cargo estimates for the iPhone 16 profit from a easy provide ramp, however sell-through for the iPhone 16 began slower than the iPhone 15.

Apple Intelligence helps enhance cargo estimates keep away from being downgraded, with 245 million items now anticipated to ship in 2025.

For the figures, J.P.Morgan raised its income and earnings forecast for the quarter to $95.9 billion and $1.63 respectively, versus its consensus of $94.2 billion and $1.59. Mac income will development relative to Q3’s outcomes, whereas iPad will decelerate.

Providers will, in fact, stay constant.

It has a value goal for Apple’s shares of $265.

Apple will get pleasure from 6% higher revenues year-on-year for the quarter, says TD Cowen, a share that can be matched by the next quarter.

The sell-in forecast for iPhone has grown from 46M to 48M items, with an 80M forecast for Q1 2025 maintained. Apple Intelligence’s phased rollout might result in “decrease improve demand.”

iPad and Mac have expectations of in-line demand based mostly on seasonality, with favorable consecutive-quarter raises of about 20 to 25% anticipated for Apple Watch and AirPods.

Providers will see continued progress by 14%, the be aware provides, although regulatory dangers are a “modest headwind” as a consequence of European rule modifications affecting funds and the App Retailer.

TD Cowen has a value goal of $250 for AAPL.

Wedbush’s October 27 be aware to traders discusses the rollout of Apple Intelligence, and can in the end “kick off a real supercycle for Apple.” Sturdy iPhone efficiency is predicted for the September quarter, with a “comparatively bullish” December demand commentary anticipated from the convention name.

That supercycle may very well be appreciable, with roughly 300 million iPhones on this planet which might be 4 years previous and ripe for upgrades. Apple might find yourself promoting over 240 million iPhones in 2025, the analysts reckon, with 100 million Chinese language iPhone upgrades doable as Apple Intelligence ultimately rolls out to that area.

Wedbush has a value goal of $300 for Apple, with an “Outperform” score.

In Evercore’s October 29 be aware, it factors to a “extra bearish” sentiment about Apple in latest weeks, with manufacturing lower noise reducing expectations for inventory consumers.

For the outcomes themselves, Apple is anticipated to ship “in-line outcomes” and that steerage and iPhone commentary can be “incrementally higher vs fears.” Threat in China is “overstated,” and can be countered by growing market progress and a powerful US improve cycle.

The Apple Intelligence rollout might additionally lead to a “stronger for longer iPhone improve cycle.”

In the end, Evercore forecasts Apple to outperform in opposition to low expectations. It maintains its “Outperform” score and $250 value goal.

AppleInsider will replace this put up when extra analyst expectations turn into accessible.